Greetings and Happy New Year and welcome to a new decade!

First of all, an acknowledgement of the difficult circumstances for our rural communities with the recent bush fires. We have a number of clients living in effected areas and are working quietly behind the scenes to make a positive contribution at this difficult time. This is a wake-up call for many of us and I will be visiting Canberra and the South Coast as soon as conditions improve.

Below are some links and/or contact details to Emergency Grants available for bush-fire victims in the fire affected communities.

- NSW Rural Assistance Authority on 1800 678 593 or visit www.raa.nsw.gov.au ($15,000 grants to help rebuild fire affected communities)

- Australian Red Cross 1800 733 276 or click on https://www.redcross.org.au/get-help/emergencies/recovering-from-emergencies/direct-assistance-contact (for emergency grants of $10,000)

- Visit Disasterassist.gov.au for NSW Bushfires: 31 August 2019 onwards

In addition, if you have friends or colleagues in these areas who need urgent financial planning advice please refer them to info@virtueandpartners.com.au

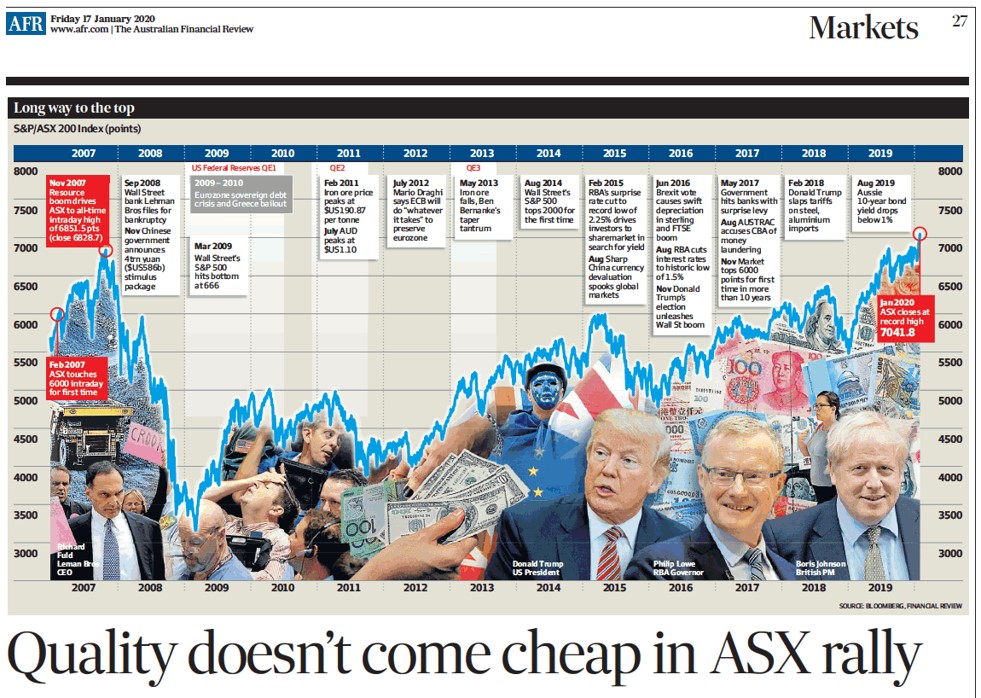

At the beginning of a new decade it is a good time to reflect on the main changes we have seen and look to anticipate and plan for the future. For me the key economic message is that improvements in technology which we are all benefiting from has now effectively eliminated inflation. With minimal inflation there is unlikely to be a material increase in interest rates and wage increases will be modest unless there is a significant increase in productivity. From an asset allocation point of view this really encourages investors to hold a high level of equities and property while keeping bonds and cash to a minimum. Indeed. at the moment it is quite possible to buy a portfolio of positively geared shares and/or residential properties with borrowed money and the associated tax benefits. Currently our domestic equity market has exceeded 7000 points breaking all-time records, and at a time when interest rates are at historic lows, while inner city property in Sydney and Melbourne has recovered from last year’s downturn and are growing rapidly. The graph below shows the growth of the ASX over the last 10 years, with CSL reaching $300 last week a standout highlight of a great Australian Company succeeding on the global stage (I had originally bought this stock 15 years ago at $4.50). At this stage market consensus is for a solid year end but not to the extent of 2019 which was an exceptional year for investment returns.

One of the catalysts for the best start to the calendar year since 1983 was the conclusion of the first stage of the trade agreement between the US and China. While a slow and torturous process this has now given some certainty as to policy direction in what will be a presidential election year in the US. Strong financial markets are regarded as an electoral positive for incumbent administrations so expect there to be supportive economic policies and minimal changes to US interest rates prior to their election in October 2020. The net effect of this is that the share markets both here and in the US while expensive by historic standards, remains fair value on a relative bases when compared to low cash rates. This also reduces the risk-free rate for valuation models for listed companies as lower discount rates translates to higher valuations and hence share prices. Therefore, any perceived increase in interest rates remains the single most dangerous indicator of any sharp decline in the share market. While currently equity market volatility is low markets do revert to longer term mean averages over time and based on the past a 10% drop due to momentum trading is quite probable this year prior to further increases to fresh market highs. With so much knowledge and awareness by investors of the effect of a small movement in interest rates central banks will need a very good reason to lift rates with the prospect of adverse market volatility last seen in the US in Dec 2018 if poorly executed.

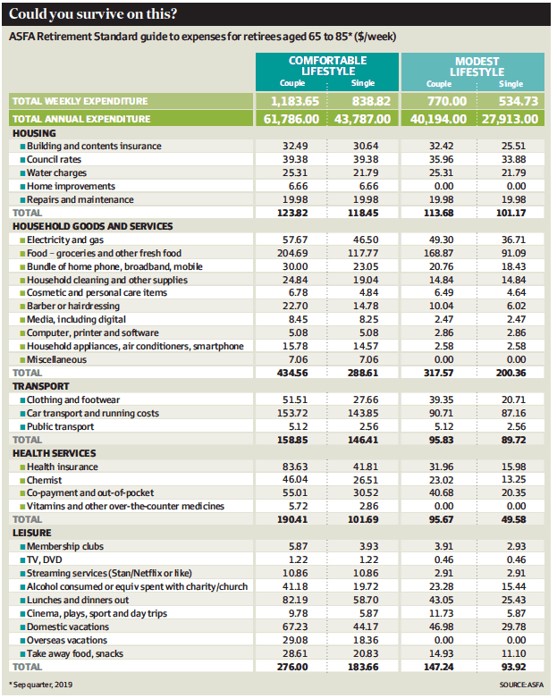

Turning to strategic financial planning retirement matters; in rough numbers as at the start of 2020 Australia has $6 Trillion of Residential property (with a combined debt of $1.5 Trillion) netting off to $4.5 Trillion. A collective superannuation balance of $3 Trillion and a stock market worth $2 Trillion with a population of 25 million (there is some double counting with these numbers but they are still significant approaching $10 Trillion). The collective prosperity of the nation is now as much around the increase in the value of these assets as opposed to further contributions. The greater issues is how from a public policy point of view we can ensure that retiree clients can draw down an adequate amount of money to achieve a dignified retirement without having to worry too much about adverse short term movements in the share market. This requires a layering effect of drawing down on superannuation; having access to the equity in their homes, the use of guaranteed lifetime income annuities and access to Centrelink to supplement income. The graph below gives a good guide as to the amount of funds required at age 65 for both a comfortable and modest lifestyle which you may want to compare with your own expenses. The message is that in aggregate we have enough assets to ensure a good standard of retirement for the majority of Australians although clearly this is unequally distributed and definitely requires professional financial planning advice to navigate a very complex regulatory system. With 700 Australians retiring daily getting policy settings right is crucial as we seek to de-risk client portfolios to produce predictable income streams for life.

Much of the prosperity of the country is linked to the residential property market, particularly in our inner cities with favourable but different tax treatment for both owner occupiers and investors. Some of the key trends expected over the next few years assummarised in the Domain include;

- Interest rates will remain low.

- Strong migration leading to population growth will continue.

- Trends towards living closer to the major cities using public transport and being less reliant on car ownership.

- More medium density and larger city apartments targeting clients choosing to downsize.

- Better designed and more energy efficient new homes.

- Tenants which make up a third of the community will have a stronger political voice.

- Ageing baby boomers will require new housing which includes low level aged care facilities and access to care assistance as needed.

This is a sector of the economy that we are very actively involved in offering clients access to developments that reflect these demographics. For those on good income a solid asset base and a 7-year investment time horizon there are some very attractive opportunities available at the moment. Feel free to contact me direct for a more detailed personalised discussion tony.virtue@virtueandpartners.com.au .This is also a very good time to review any mortgage facilities you have, as access to credit does seem to be finally improving and we appear to be close to the bottom of the interest rate cycle based on long term bond rates.

The year ahead does look to be busy with plenty of opportunities for investors to benefit from the current low interest rate environment. As usual, we will be screening and selecting suitable investment options for clients as they become available in what is a very dynamic and changing financial landscape. As we enter into our 30th year as a privately-owned financial planning practice we remain as committed as ever to delivering a personalised long-term trusted service to our community while continually looking at better ways to improve our client experience. We welcome your referrals and encourage you to review our website at www.virtueandpartners.com.au

Sincerely

Tony