Good afternoon and Happy New Year,

Now in our 36th year, I will continue to write monthly, updating you on relevant financial matters.

I do hope that you all got some rest and are ready for whatever this year brings, and we look forward to seeing you face-to-face as the year unfolds.

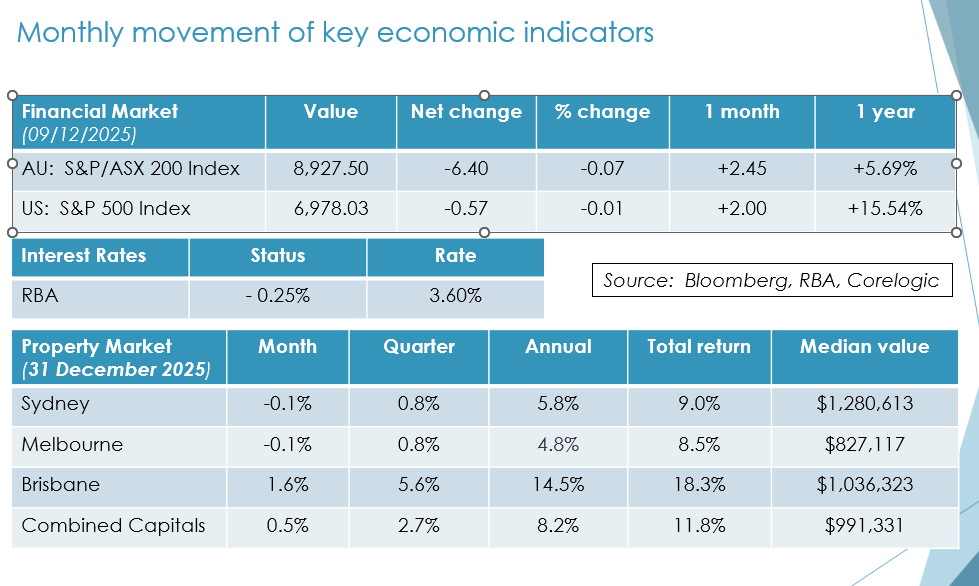

Australian CPI and Inflation

The annual headline consumer price index came in at 3.8% on a rolling 12 months to December allowing for seasonal adjustments to trimmed meaning it came in at 3.4% which was significantly higher than the RBA forecast. The effect of this is that it is quite possible that the RBA will lift interest rates now in February. At the very least this does look to be the bottom of the interest rate cycle and should be seen as a negative for both property and shares more generally. It is possible these numbers will be revised down at a future date, but the trend is up as can be seen in the attached graph. Breaking this down there was sharp increase in housing (5.5%), domestic holiday travel and accommodation (9.6%) and food and non-alcoholic beverages (3.4%). Some of the discretionary spending here may well be coming from retirees drawing down on their allocated pensions.

Annual Inflation Rate (%)

Source: Australian Financial Review (2026)

The labour market remains tight with an effective unemployment rate of 4.1% as of December 2025 and a participation rate of 66.7% which is a positive for the economy. The tight employment numbers need to also reflect in improved productivity particularly through the effective use of AI to ensure that jobs created are of a very high level of skill that genuinely add value to the end consumer. Much of the growth in employment has been in the public sector with the Australian Bureau of Statistics stating that 87% of the growth in employment since March 2023 has been in areas tied to government services such as education, healthcare and public administration. This may be putting pressure on inflation and if interest rates do rise this could become self-perpetuating with workers needing higher wages to cover higher mortgage and rent payments. To be clear it will be the highest priority of the RBA to get trimmed inflation back in a 2-3% band quickly. This is particularly concerning as the US continues to drop its own interest rates leading to the Australian dollar increasing substantially.

Global Geopolitical News

The situation in Iran now looks like coming to a head any day with the US assembling a formidable armada heading towards the region. To some extent this has been expected for quite some time, but it does lead to enormous uncertainty and in part has led to a trend to purchasing precious metals such as gold and silver both of which have grown substantially in value over the last few months. There may well be some short-term volatility in share markets particularly any investments that are oil related. You will recall that there were a number of major incidents last year in the region, but equity markets remained calm and in the US they have had 50 successive all-time highs over the last six months.

Gold Price Last 12 Months

Source: Goldprice.org

Trump style of negotiation has become increasingly clear of seeking to use overwhelming force both militarily and economically to force adversaries into backing down or replacing regimes. We saw this a few weeks ago in Venezuela and it is perfectly possible that there will be a similar outcome in Iran. The subject of Greenland and its strategic value to the US is also now being negotiated with the Europeans and will probably be resolved through an economic payment to Denmark.

While we seem far away in Australia this does seem quite surreal and with the ready access to social media very confronting and it is at times like this that we need to keep a clear mind and retain a long-term view in our investments. The key drivers of share markets remain the successful use of technology to improve products and processes and relatively benign interest rates to encourage entrepreneurship and risk taking. There are many positive things happening particularly in the health sector and we need to keep this in mind when watching some of the news both here and overseas.

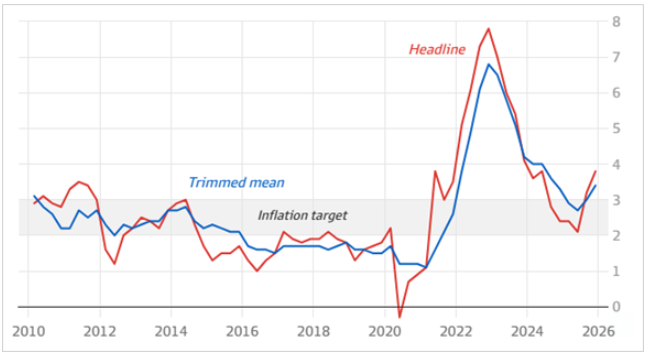

Technology and The Effective use of AI

Australians have always been very quick adapters of technology and the practical use of AI to improve all our lives is now becoming commonplace and revolutionising work practices. The Austrian economist Joseph Sumpeter just after the Second World War described these technological changes as ‘creative destruction’. For a period there may seem to be chaos, but a better solution is found that improves the wider wellbeing of the community. In many cases it is easier to establish a new business rather than restructure an existing one with examples such as Uber, Airbnb, Spotify and Netflix now well established as leaders in their respective fields. Each of these ideas could have been taken up by existing providers who missed their opportunity by focusing too much on protecting their existing businesses rather than being prepared to disrupt their existing business model to provide a better, longer-term future.

The growth and cheap access to AI should lead to multiple new business opportunities and lower barriers to entry. Much of these services are available via apps on our mobile phones and will target bespoke markets within our community particularly in health and lifestyle. As an example, I do a 15-minute lesson each day on improving my AI skills which I find invaluable in understanding a significant amount of market data quickly that sometimes feels contradictory. This should also improve our time management skills, reduce mundane activity and allow more free time to do the things we really want to do with our lives. Companies such as Life360 which while US based is listed in Australia is a good example of this technology really working effectively to keep track of both your family and pets and producing a valuable company worth investing in.

The message remains that we should stay positive about future investment opportunities while being prepared to rotate from older companies that may be past their best into newer companies with fresh management and better use of new technology. In part this is of course the job of fund managers particularly in the small company space and we are seeing some good results coming through at the moment.

AI Adoption by Australian Firms 2025

Source: Reserve Bank of Australia

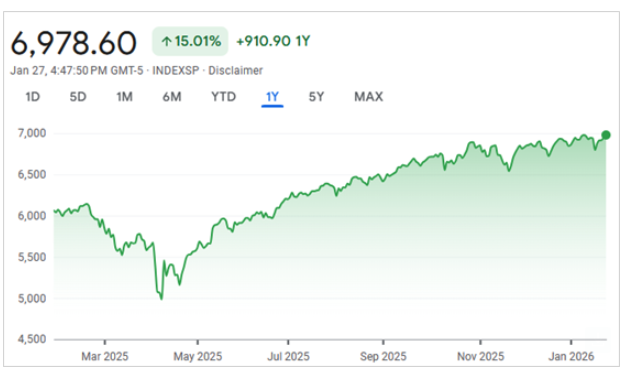

Australian Reporting Season

There has been quite a rotation in the last few weeks out of the banking sector into the resources market with BHP now overtaking CBA as the largest company on the Australian stock market. Our investments in the domestic ETF Australian share indexes will cover these rotations automatically. While our active fund managers should be front and centre at adjusting portfolios to reflect these rotations. Next week starts the interim earnings season for the ASX and we’ll give a good guide as to the probable outlook for the 12 months moving forward. You would anticipate that the effective use of AI will reduce the cost of doing business, but there will be margin pressure for revenue. The Australian listed stock market is shrinking now with many companies choosing to stay private and we’ve so much superannuation money coming into the market. This should provide a level of protection against any downside on Australian shares.

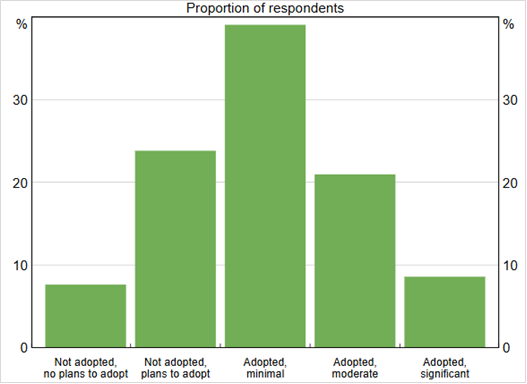

International Shares

Trump has been talking up the 5.4% growth for the year to December 2025 for the US economy which if correct is quite an achievement. This has been reflected in the stock market which has now clocked up 50 new all-time highs over the last 12 months almost exclusively via the Magnificent Seven, which we speak of regularly. The natural question is whether the stock market now is overpriced and we really must be cautious until it becomes clear that all this AI is being effectively used in the communication in the community, including managing the social impact on the working community.

S&P 500 Index – Last 12-month performance

Source: Google Finance

A new governor of the US Federal Reserve will be appointed shortly it is highly probable that he will be more supportive of lower interest rates supporting Trump’s policies. In aggregate if technology really does take off at a higher level this should in fact reduce interest rates due to greater efficiency. The big seven are all reporting their earnings later this week and next week which will give us a better guide as to the outlook for the year. As an example, Meta was up 10% overnight (Meta owns Facebook and Instagram).

Our news

With so many in our community now approaching retirement we are as busy as ever and increasing our team. We do not advertise publicly and as such rely on referrals from family and friends and have ensured that we have adequate resources to provide you with the advice you need to provide peace of mind in your financial affairs.

This is a great privilege to serve our community in this way and something we will never take for granted.

Sincerely

Tony and Fiona

Please note this newsletter is of a general nature only. Click to our websiteABN 42 060 673 814 • AFSL No. 407238