Greetings

Globally the last few weeks have been focused on the Coronavirus emanating in Wuhan Central China, and the potential impact on both lives and global economies, should this develop into a major epidemic outside of China. The natural response to this is to be cautious and quarantine anyone potentially affected. As of today, there have been 3 deaths outside of China (2 when I recorded the video yesterday) with 15 cases reported in Australia the number of new daily reported cases in China seems to have peaked as the incubation period of 14 days passes. That said there have been over 1,000 deaths mainly of the elderly in Wuhan. The table below from the South China Post shows the current state of play.

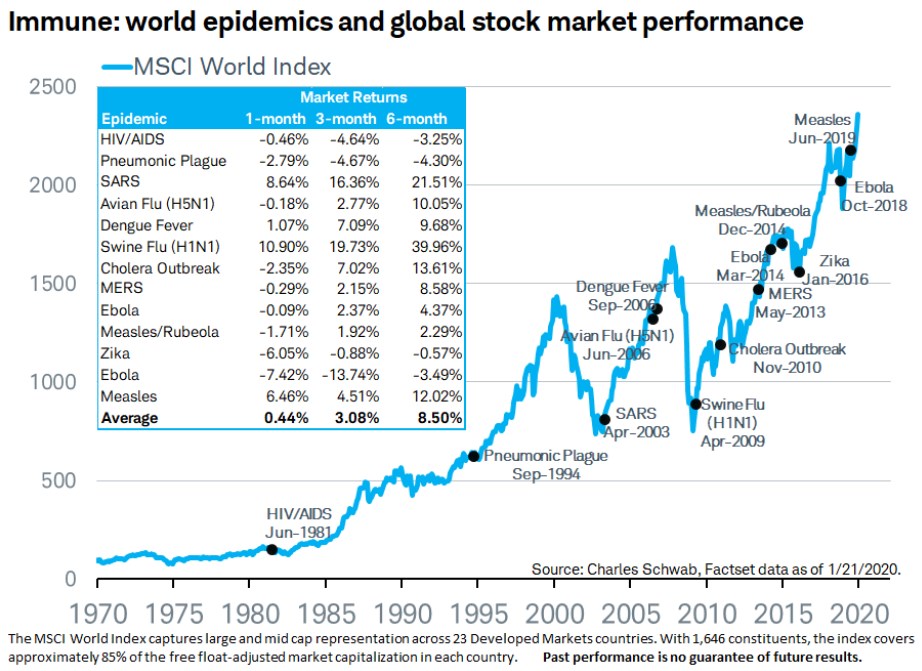

From an economic point of view, contagious virus’s go back a long time, including the Black Plague in London (1665 to 1666) and to some extent act as a way of nudging society out of any complacency limiting population growth. Markets tend to sell on rumour and buy on fact and is demonstrated in the table below or recent epidemics over the last 20 years often rebound quickly. The SARS epidemic which also emanated out of China in 2003 is the nearest proxy to Coronavirus and hopefully authorities and doctors have learned from this in treating the current problem. Australia relies heavily on exports to China which has increased from 8% in 2003 to 34% today so any lasting downturn in the Chinese economy would affect our domestic exporters hard including BHP, RIO and Fortescue (Blackmores had a dreadful downgrade in their interim’s).

Perhaps counter-intuitively, global equity markets powered on with the main US Indexes all hitting new all-time highs overnight, based on a combination of good company earnings results and very low cash rates making stocks expensive on an absolute historic bases but fair value relative to cash and bond rates. Overtime we must expect some mean reversion and a correction of 10% is perhaps overdue. However rather than chasing shadows the immediate factors driving markets over the next 12 months in the US will be their Presidential election and there is nothing like a strong stock market and economy to help get the incumbent re-elected. It will be a brave US Federal Reserve Chairman to consider lifting interest rates this side of the election no matter how overheated their economy may become.

Domestically we are half way through our interim reporting season which so far has been quite solid. Our two largest companies by market capitalisation CBA and CSL both exceeded analyst expectations (I first bought CSL at $4.50 now trading at $330 ). Moreover, our concentrated direct Australian share portfolio has done extremely well over the few years but again now looking expensive based on fundamentals. So while investment returns have been very strong, recently we must temper our expectations moving forward and take any corrections in our stride. The wider economy is struggling and companies remain focused on disciplined cost cutting due to improved technology rather than top line revenue growth. In many ways, we have a multi speed economy with some technology based companies doing very well while retail related stock, with the exception of JB Hi-F, continue to struggle.

The services sector remains the nation’s largest employer and greater use of technology continues to remove low level jobs as the “creative destruction” continues (Schumpeter c 1930’s). Job security is crucial to consumers spending money, buying properties and underemployment and contract labour is becoming a growing social issue in our community. With the growth of Artificial Intelligence and Robotics replacing human capital, the reality is that employees may well end up with shorter working weeks and more leisure. The economic and social issue being where the financial benefits of these efficiencies are distributed between shareholders or employees and or contractors.

The Sydney and Melbourne property market continues to rise rapidly, due to relaxing of lending standards and record low interest rates. Many new investment properties are now positively geared based on a 20% deposit and generous depreciation allowances. For those with good equity in their home and stable work there are good opportunities to invest in good inner city developments designed to benefit from the changing demographic of the nation including the trend towards downsizing and convenient living for the empty nesters among us. We do have strong relationships with leading award winning developers in this sector to assist you in investing in a safe and measured way.

Further more detailed commentary is available on our website www.virtueandpartners.com.au and as always we welcome you and your friends to our two offices in Manly and the CBD info@virtueandpartners.com.au for appointments.

With my best wishes

Tony