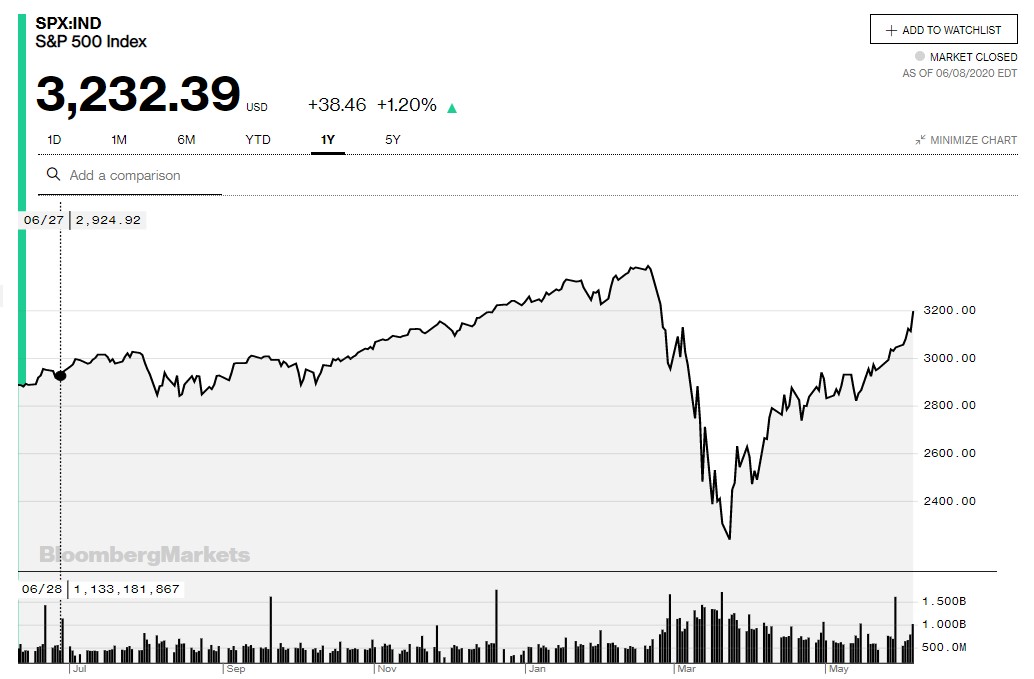

Quite a rally on stock markets both here and overseas recovering much of the losses since mid-March. The immediate catalyst appears to be that the damage to global economies from the corona-virus might be less than first thought. The US jobless rate actually decreased significantly on Friday Leading to an improvement in sentiment and a nearly 1,000-point jump on the Dow Jones. Perhaps counter intuitively all the major US markers are currently up on a rolling 12-month bases led by their large global tech companies.

This is of course in stark contrast to the very sad scenes we are watching on World TV in relation to both the human devastation of the corona-virus and the global protests witnessed over the weekend. So, we live in very unsettled times and keeping a calm mind to investment decisions is not easy when confronted with such uncertainty. We understand the concerns of our community and are here to talk things through with clients as needed – 02 9977 8800.

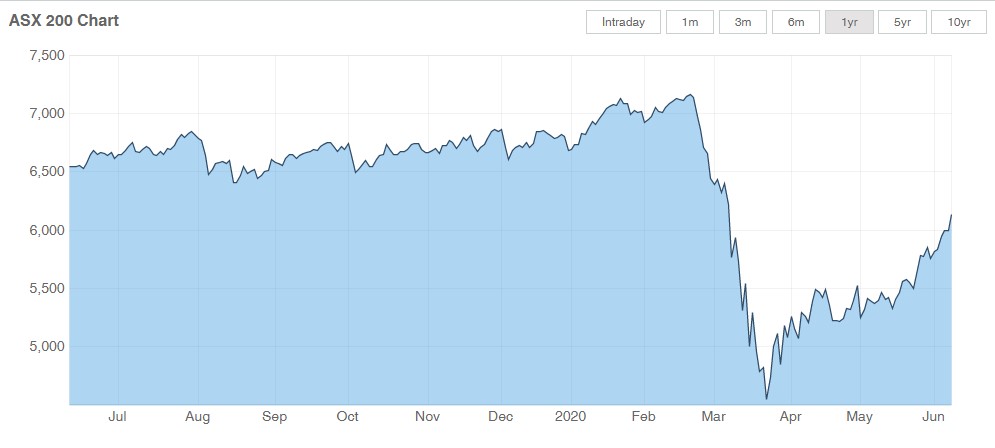

The domestic market has also lifted 30% from its mid-March lows with the banks rallying strongly on the bases that the likely amount of mortgage defaults and corporate failures may now be much lower than originally feared. That said the country appears to be going into at least a technical recession at the end of June and we must not underestimate the very substantial debt and unemployment that will impact on the nation’s financial future.

Source: www.marketindex.com.au

Source: https://www.bloomberg.com/markets

It is good to see our local cafes and restaurants reopening and equally importantly the minimal amount of reported local cases of the virus so hopefully we can get our economy rebounding as quickly as possible. This will need to come primarily from domestic consumption as overseas tourists and students will not be allowed into Australia in the immediate future. The quickest approach is to stimulate the housing market via ultra-low interest rates now below 3% in many cases and targeted grants for renovations and new builds of $25k subject to strict qualifying criteria.

There are currently just over 10 million residential dwellings in Australia of which around 73% is owner occupied. The collective value of these dwellings is $6.8 Trillion with debt of $1.8 Trillion or an effective overall gearing rate of 26%. There are more than 2 million property investors and the total sector makes up 51% of household wealth. In context our superannuation pool is now approaching $ 3 Trillion again. At this stage property prices look to be fairly stable but ultimately safe full-time jobs will determine if this remains the case later in the year as the Government reduces financial support via the Job Keeper program.

Anthony Virtue is inviting you to a scheduled Zoom meeting.

With the growth of Zoom as a communication medium I will go through this newsletter in greater detail online this Thursday at 1.00 pm which will be recorded for those Clients who wish to watch later.

Topic: Virtue & Partners – “As I See It” June 2020 Update

Time: Jun 11, 2020 01:00 PM Canberra, Melbourne, Sydney

Join Zoom Meeting

https://zoom.us/j/94019524226?pwd=L2dsK1FyellaQjY2c3c2TVdTOTQxUT09

Meeting ID: 940 1952 4226

Password: 757862

As we approach the last few weeks of a difficult financial year there are some tax planning opportunities to consider:

- Superannuation contributions of up to $25k, work related (concessional) or up to $100k personal after tax (non-concessional).

- Gearing into shares or managed funds with interest rates now below 4% and below long-term dividend yields.

- Instant asset write off up to $150 k per asset for those of you with an ABN.

With my best wishes

Sincerely,

Tony