Greetings

The last few weeks have been dominated by the news of a second outbreak of Coronavirus in Melbourne and the probability of this spreading into NSW. This is a difficult time for our community both from a health and economic recovery point of view and as such we are naturally being very cautious in making significant decisions until the data supporting the suppression of this virus becomes clearer. There have been similar secondary outbreaks of the virus in countries that had done well in managing the initial first wave notably Israel, Singapore and Japan. The primary spreading is coming from people living in very close proximity and not being able or willing to social distance enough to choke off the spread of the virus. While this continues, we will conduct the majority of our meetings by Zoom or similar to ensure all clients are kept as safe as possible while still providing access to quality personal advice in a timely manner. We have also upgraded our website which includes the capacity to make online bookings with our advisers as needed.

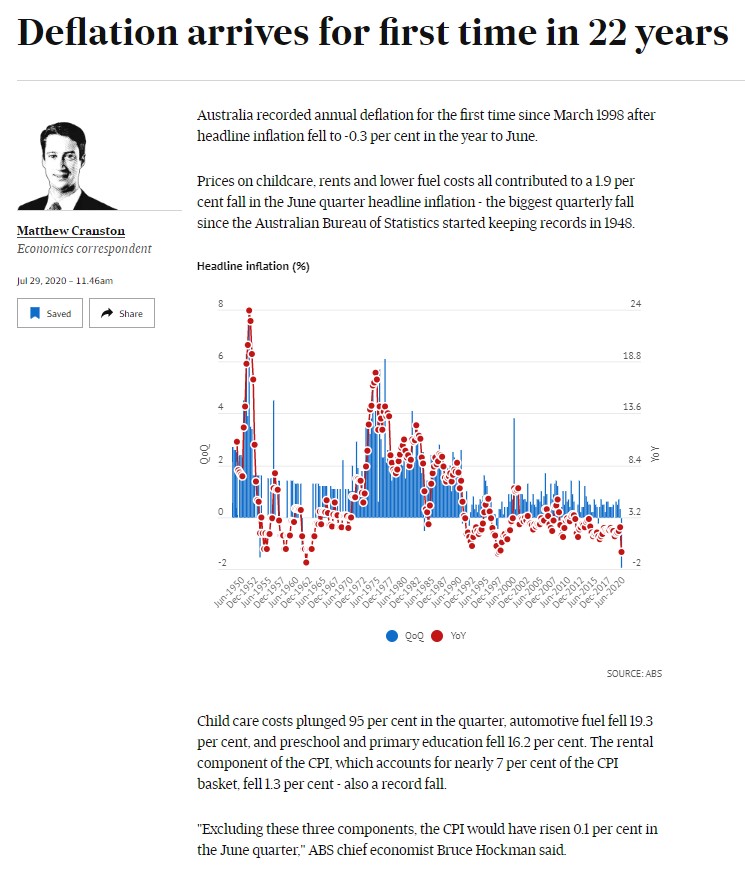

Turning to the effect on the economy the Consumer Price Index (CPI) released today showed a negative -1.9% for the quarter showing deflation for the first time in 22 years. The attached graph courtesy of the AFR shows that the major contributors were Childcare (via Government rebates), rent and lower fuel costs. This has collectively translated to slightly lower living costs which in part will offset the rising underemployment in our community at this time. With annualised inflation now around 1% and well below the RBA target band of 2 to 3% it is highly unlikely that interest rates will increase for the next three years. Indeed the RBA via the Australian Office of Financial Management (AOFM) raised $15 Billion yesterday of 30 year bonds below a 2% coupon. So we must expect both the cost of borrowing but also the earnings on risk-free savings via term deposits to be very low for an extended period. This will be quite an adjustment for our community who have experienced 29 years of uninterrupted economic growth with no one under age 47 living through a recession in their adult life.

One of the key decisions for our Major Banks at this time will be their Dividend Policy as they try to juggle their responsibilities to shareholders, customers and the wider community. The Australian Prudential Regulatory Authority (APRA) have today directed all listed companies on the ASX to limit their dividend payout ratio to 50% and to continue to provide extended repayment relief to borrowers. This could have been quite a lot worse relative to similar Regulatory regimes in the UK and Europe where dividends and share buy-backs have been banned for the immediate future. The major banks currently pay out around 70% of their profits in Dividends so this would equate to a reduction if full years dividends of around 35% subject to maintaining a similar level of profitability still fully franked. Banks will also be allowed to reduce their capital reserve ratio to support the economy at this time and will not need to recognise pauses in mortgage payments as bad debts for reserving purposes.

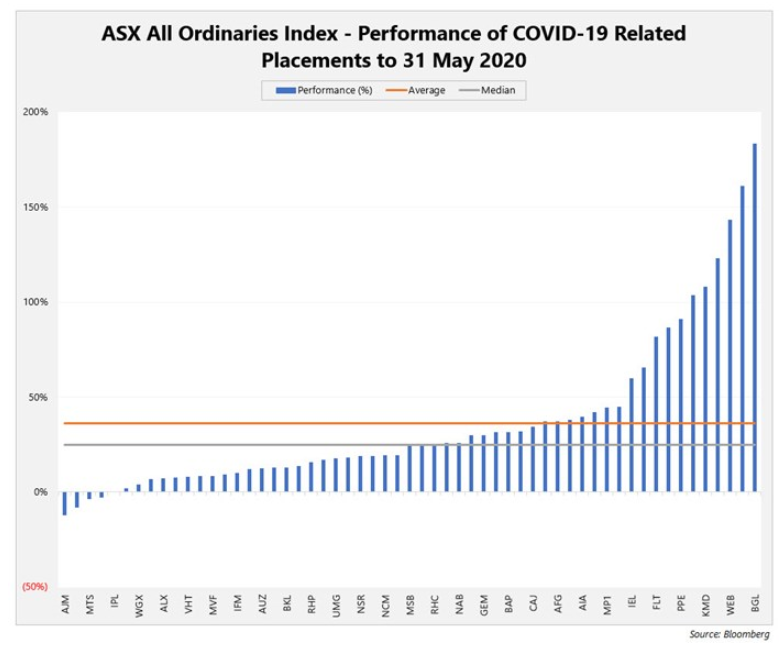

As the 4 major banks, dividends have historically accounted for 50% of the total payout of the ASX. This is very important and will impact on actual cash flow to investors whether by direct investments of via managed funds. CBA are due to report their final dividend next week which will provide additional guidance and a market expectation of $1 fully franked making $3 for the year (last year was $4 for the full year). Companies have embarked on capital raisings to protect their balance sheets with 37 listed firms raising #13 Billion over the last three months so at this stage we are looking at a 6 to 12 month delay in profitability and dividends rather than the outright collapse of credit to fund public companies. Similarly, in the listed commercial property market while there have been write downs in valuations, especially with Shopping Centres, access to cheap funding has offset the loss of rent and gross yields for the sector remain reasonable.

Globally equity markets have held up remarkably well given the loss of production due to national lockdown strategies. This has been underpinned by very supportive central Government policies around the world, notably the US, UK and European Central Bank (ECB) with cash rates now minimal and credit flowing freely to support their respective economies including direct wage subsidies. All of this translates into a higher than desired level of Government Debt funded by minimal long term interest rates as governments try to juggle their responsibilities to ‘lives and livelihoods’. Much of the growth in share markets are concentrated in a few Technology driven companies both here (WAAX”s -Wisetech, Afterpay, Appen, Xero) and in the US (FAANG’s-Facebook, Amazon, Apple, Netflix, Google) without which, return’s would be significantly lower. These investments, particularly in Australia, do look fully prices based on absolute historical data but relative to minimal interest rates in the bond market probably a reasonable option as a modest part of a share portfolio. We have access to a wide rage of Exchange Traded Funds (ETF’s ) that can duplicate these sub sectors of the market while avoiding stock specific risk.

Year-end reports will be out soon and we will be conducting our usual reviews although mainly online rather than face to face. All things considered returns have been solid with International Shares the stand out. After a very difficult first calendar quarter, equity market markets recovered between April and June recovering much of their losses. Fixed Interest returns were modest reflecting current yields but with minimal actual defaults. Residential and Commercial property held up but with current employment issues being top of mind, rents are likely to decrease next year which will reflect in distributions. We will be looking at solutions for retirees who will see their income from investments drop on a case by case bases. As always we will look beyond the immediate environment and focus on likely future opportunities and for clients as business conditions normalise.

Sincerely

Tony