Good morning as we look forward to spring in a few weeks’ time.

Sadly news is still dominated by the effect of the second wave of Coronavirus, primarily in Melbourne. Naturally this is impacting on all or our lives as we follow updated information daily and seek to navigate through these “unprecedented times”. By way of history as a guide the Spanish Flu ran from February 1918 to April 1920 and infected around 1/3 of the world’s population over 4 distinct waves. Over 500 million people were infected with a death toll up to 50 million. So caution is naturally top of mind as we carefully navigate our way through this period and seek to limit any sickness in our community. Click here for more information regarding the Spanish Flu: https://en.wikipedia.org/wiki/Spanish_flu

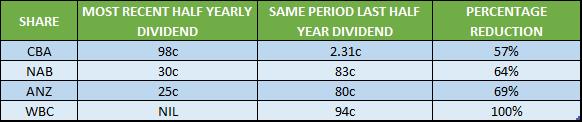

Domestically we are just completing the annual reporting season to the end of June. There has been a wide diversion of results as you would expect with the banks struggling and reducing or deferring dividends while resource stock and online business have done extremely well. The reduction in bank dividends will have a significant effect on actual distributions to retirees accounting for 50% of the historic total dividend pool of the ASX (all franked). It is important to remember that this reflects the deferral of around 10% of clients mortgage payments but at this stage there have been minimal defaults and so dividends should recover next year.

Naturally this is very disappointing and will mean finding income from other sources or selling down a small component of portfolios to cover retirees living expenses later this year. In addition to reserving for loan defaults regulatory fines particularly for Westpac with the AUSTRAC case has really limited the capacity of banks to meet the dividend expectation of shareholders. With the lack of travel reducing many clients discretionary spending this year, we will work this through on a case by case bases at each client review. It is also most likely that the Government will continue to allow smaller mandatory draw-downs on allocated pensions which will at least allow more flexibility in the timing of payments.

This challenges much of the traditional investment strategies in Australia around buying blue chip shares paying consistent dividends rotating to more growth orientated stock even if dividends are less certain and valuations stretched by historical standards. This is much more common in the US where investments are primarily made based on future earnings growth rather than dividend payment expectations. We have adjusted some of our fund manager selections from value based to growth orientated to capture this growing trend in market sentiment.

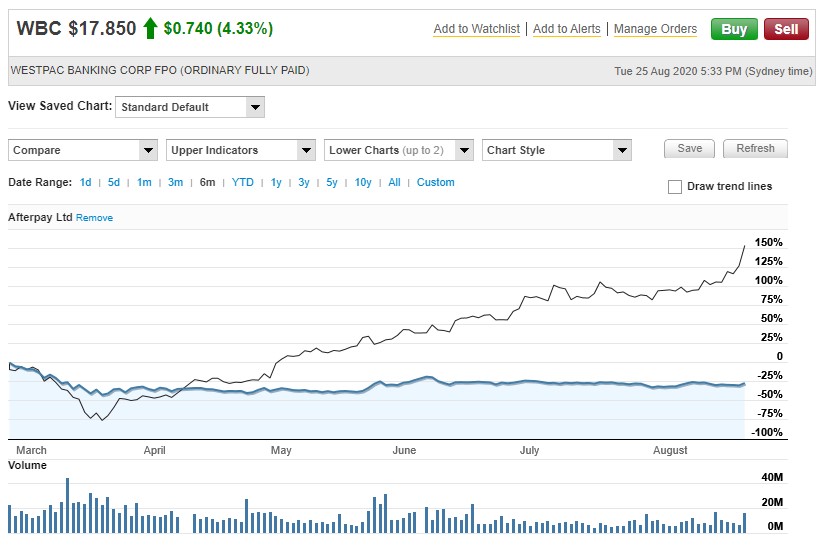

There is now a new Exchange Traded Fund (ETF) over our domestic technology index ATEC which is a quick way to access on a weighted bases what has been known as the WAAX’s (Wisetech, Appen, Afterpay, Xero, etc..). These companies have done extremely well and now make up a larger part of the wider ASX 200 index. The graph below compares the 6 month performance and valuation of Westpac ($62B ) compared to Afterpay ($22B).

Overseas the large technology stocks continue to power along with Apple now valued at $2 Trillion greater than the entire Australian Stock Market.

Once you add up the collective market capitalisations of the FAANG’s (Facebook, Amazon, Apple, Netflix and Google) you reach close to $4Trillion of 15 % of the total US market. Indeed of the 500 largest companies in the US as reflected in the S&P index only these 5 companies have really grown in value since the outset of Coronavirus. We offer clients exposure to these investments via IVV (the ETF for the 500 largest companies) and increasingly on a direct bases via recent improvements in Wrap Account technology. Full details on our upgraded website www.virtueandpartners.com.au

With a presidential election due in early November 2020 we may get some additional volatility as investors adjust portfolios to reflect the likely winner and possibly some further trade issues with China in the runup to the election. Generally polls get much closer to the date and we have had a number of recent elections with surprise outcomes, so watch this space.

Meanwhile residential property in Sydney seems to be holding up with investors able to defer mortgage payments for up to 6 months. Spring is traditionally a busy time for property auctions and this will provide a better guide as to the likely future trend of the market. At the same time we are very busy in the mortgage side of the business helping clients get access to some of the cheapest loans on record. Refinancing across the sector is at record rates making many investment properties cash flow positive even in some Sydney suburbs. Our broking team led by haydn.dale@virtueandpartners.com.au can quickly and seamlessly update you on better options now available on new mortgages and assist in the transition process. Commercial property remains mixed with logistics warehouse business’s such as Goodman Group and Charter Hall faring well while shopping centres such as Scentre (Westfield) and Vicinity being handicapped by the restrictions in Victoria.

Year-end reports will be out soon and are surprisingly strong all things considered. The main drivers of this was our lower holdings in investment grade fixed interest and retaining our holdings in both domestic and international shares throughout the decline and then recovery of markets in the last 6 months. Once finalised we will organise client meetings to discuss including increasingly ZOOM as a preferred measure of client communication. Thank you all for your kind words and best wishes at this time. We are all well and working around the clock to achieve the best outcomes possible for clients as circumstances dictate. We welcome your continued referrals at info@virtueandpartners.com.au

With my best wishes

Tony