Greetings as we head towards Christmas!

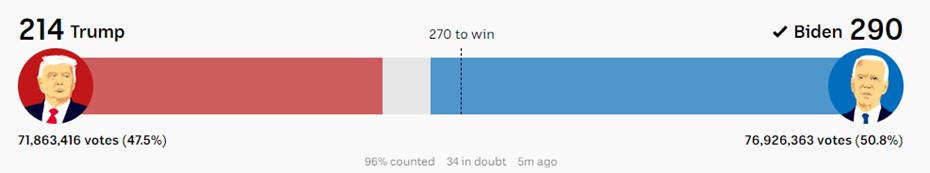

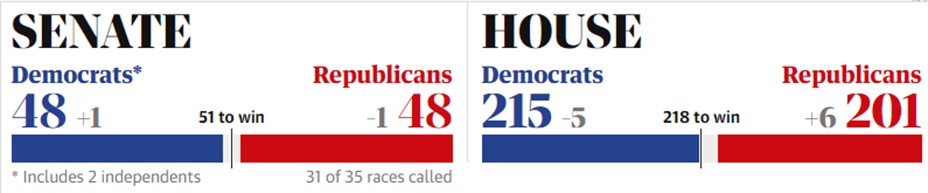

The news is currently dominated with the results of the US Presidential election which happens every 4 years in November. As has widely been reported in the mainstream media, a solid but not spectacular victory for Joe Biden of the Democrats with a likely split of power between the Senate and the House Of Representatives will mean that their Congress is unlikely to do anything radical and will probably muddle along. Any appeal from the current President is unlikely to impact the overall decision of the voters and his influence is likely to be muted at best in the caretaker period to the 20th January when the new President formally takes office. Markets adjust quickly to new information and there will now be a reset of the prospects for different segments of their domestic economy and of course any changes in foreign policy including the prickly relationship with China. The new President Elect who has had more than his fair share of tragedies has been in politics all his life and is seen as a man of consensus in sharp contrast to his predecessor and more likely to focus on unifying a very divided country.

Overnight we have had news that Pfizer has had good results with a vaccine breakthrough that appears to be very promising and led to a bounce of 1600 points on the Dow Jones at the opening bell to a new all-time high. Equity markets, particularly in the banking sector, have started well today and short selling volatility is evaporating quickly. Travel related stock and airlines are also doing well while stay at home technology stocks declined as investors rotate stock selection to reflect the prospects of the global economy reopening at some stage next year. While there have been some false dawns in managing the coronavirus there is a growing consensus in the scientific community that a vaccine is imminent. In the meantime, company’s like Roche who conduct 90% of the tests in Australia, can get an accurate reading in 15 minutes which should help in managing airline passenger risks etc.

That said the longer-term economic damage caused by the Coronavirus and a very substantial national debt will become a sobering influence once the euphoria evaporates but with cash rates at zero there is very little alternative than holding a level of risk through equities. Markets hate uncertainty and a period of calmness and cooperation in globally coordinated economic policies will allow business to get back to work in a more coordinated and planned manner hence the re-rating of some stock over the last few days. As always, we need to take this news in our stride and retain investment discipline but based on previous market recoveries, we should see a new all-time high in our domestic market possibly next year.

The graph below shows the state of play at the time of writing.

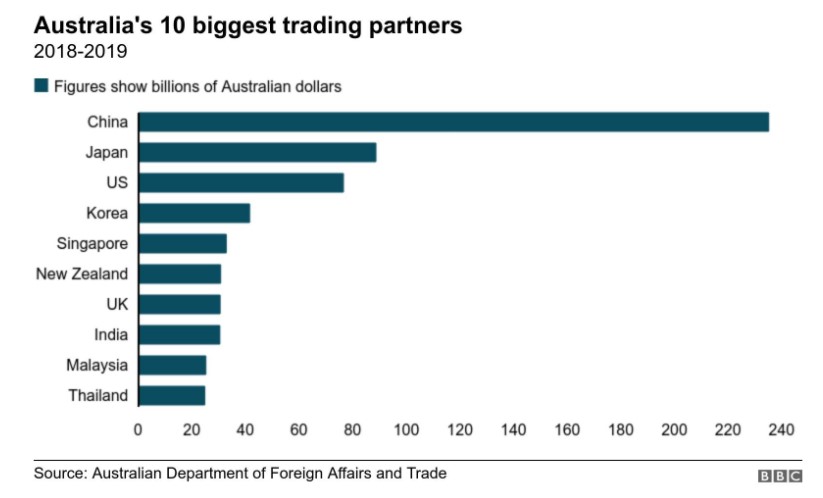

While the US election is important to Australia’s interests, equally relevant is our relationship with China who is our largest trading partner. Tensions continue with our exports and high discretionary purchases of wine and seafood which may be seen by their authorities as a little decadent. At the same time our key industries of Iron Ore and Coal continue to attract premium prices in the region as China looks to stimulate its economy with projected Gross Domestic Product back to pre-Covid-19 levels. Much of the success of the Australian economy over the last 30 years has been linked to our exports to China and the region more generally and this is something we must not take for granted. However, by global standards, Australia’s handling of both the virus and the economy at the same time is seen to be well managed by the international investment community and should lead to a further re rating of our economy as a good place to invest safely. We are also seeing a significant number of returning Australians from working overseas which appears to be supporting the domestic property market as they re enter the housing sector. The graph below shows our major export markets by country and by product.

As anticipated, the RBA dropped interest rates to 0.10% at its Melbourne Cup November meeting and more importantly commenced a $100 Billion buyback of Government bonds which is effectively our version of quantitative easing. This combined with a statement that interest rates are unlikely to change for at least 3 years and until unemployment is comfortably below 6% should put a fuse under property prices. We are already seeing some significant price increases on the Northern Beaches and with such cheap financing available this has every likelihood of continuing for the immediate future. This is also an excellent time to consider fixing some of your mortgage arrangements with rates around 2%. We are able to quickly review your current arrangements and advise on options with both your current and potential alternative providers. We also have access to a wide range of investment properties and maintain close relationships with local real estate agents for those looking to buy into this market.

So to wrap up, a coordinated attempt by the Federal Government to get people back to work through effectively subsidising the private sector until the business community can operate effectively again. The quickest way to achieve this is minimal interest rates and supporting the property market to rebound providing equity for owners to reinvest and builders to employ contactors. Equity markets should continue to do well with such a low risk free rate hurdle to achieve. The risk now could be a bubble in the investment market which could be hard to contain without changing monetary policy. Greater details on these issues at www.virtueandpartners.com.au

Locally we are pleased to confirm our Client Function being held at the Manly 16ft Skiff Club on Thursday 10th December with Covid-19 restrictions to be strictly enforced. Thank you for your continued referrals. Please email info@virtueandpartners.com.au for prompt service.

With my best wishes

Tony