Greetings as we welcome in a new financial year.

Many of us are currently in a lockdown, especially in Sydney, and hopefully we can get back to normal very soon. Our team are all working from home, and we are operating normally with a emphases on assisting our most vulnerable clients who are isolated at this time.

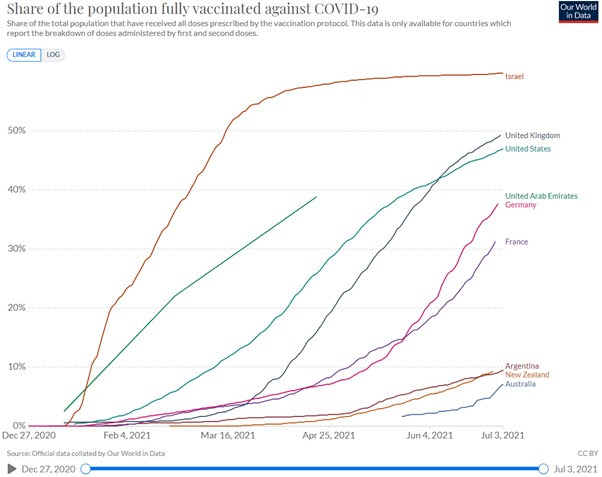

Clearly there is a rush to have the community vaccinated as soon as possible and life returning to normality without this constant fear of being forced to stay at home. Government policy changes to focus on protecting the seriously ill rather than seeking a zero transmission across the whole community seems a far more logical balance between lives and livelihoods and is consistent with what we are now witnessing overseas, particularly in Europe and the US. The delay in getting the Pfizer vaccine into the country and mixed messages on Astra Zeneca has slowed the process down reflected in the two graphs below showing that while we were close to the top of the class in managing the virus, we are close to the bottom with the vaccine rollout. Internally all team members have been vaccinated when available for their age group.

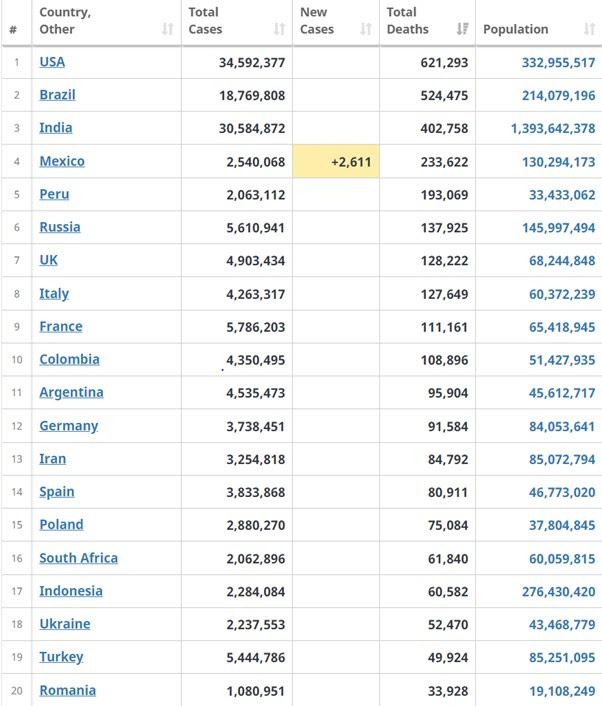

Global coronavirus deaths by country. Source: Worldometer

* Australia is at position 111 with 910 deaths.

Global vaccination rollout. Source: Our World Data

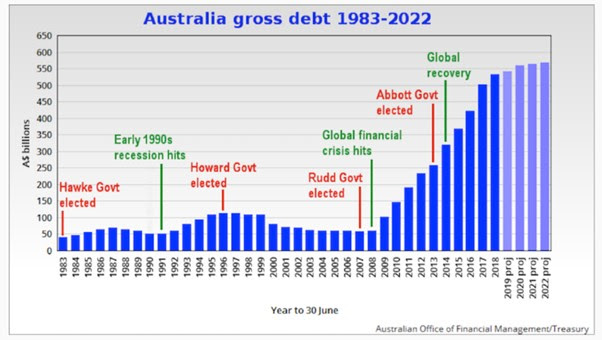

Reviewing the financial results for financial year 20/21 we have seen an exceptional growth in both equity and property prices supported by record low interest rates. The collective wealth effect on the community while unequal, cannot be understated with a once in a generation jump in the value of assets of around 20% or $2.5 Trillion (more than the size of the Australian stock market) shared between approximately 25 million citizens or $100,000 per person. Naturally, all asset classes eventually revert to longer term growth rates, and it would be most unlikely that these numbers would be repeated once the country and the global economy more generally gets back to normality and interest rates begin to rise. The corollary of these numbers are an increase in Federal debt to $1 Trillion. Effectively the Commonwealth has funded the growth of the communities’ assets through a combination of low interest rates and financial support for workers throughout the pandemic. The challenge now will be to convert the growth in these assets into predictable income streams to replace personal exertion work as the community ages and front-line work becomes automated. In context we have seem very similar asset growth in comparable overseas countries, especially the US.

Australian Federal Debt. Source: Aust Office of Financial Manangement/Treasury

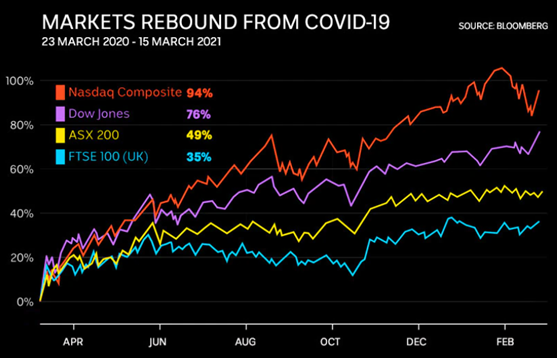

Turning to the Australian Equity Market the recovery from the depths of the lows in March 2020 continued throughout the financial year and turned in its best result since 1987. The recovery in the banking sector led by CBA now above $100, has been encouraging and the restoration of dividends to pre pandemic levels allows an opportunity for investors to get a reasonable yield on their shares again approaching 5% across the ASX 200 index. This is important as the need for income remains critical irrespective of how large an illiquid asset base some clients have particularly in their family home. The increase in iron ore prices was also favourable to our three main miners and allowed a very significant increase in dividends to shareholders and helped improve our balance of trade and reduce net federal debt through increased company tax.

ASX performance 20/21 compared with other markets. Source: Bloomberg

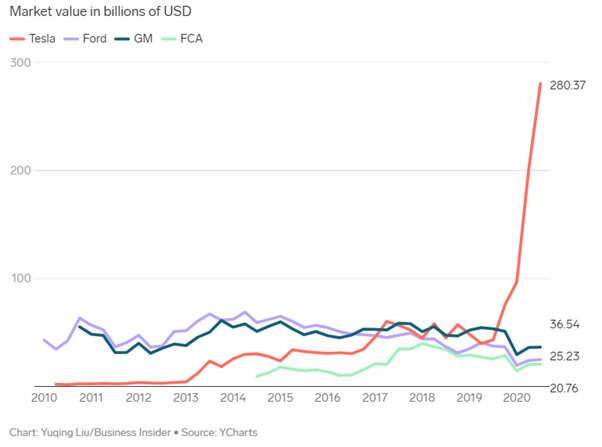

The global equity position as even stronger with five US companies now worth over $1Trillion each (Apple, Google, Facebook, Amazon and Microsoft) with the commonality being effective use of technology and limited need for capital. As such retaining a good asset allocation globally makes sense for all but the most conservative of investors, and again has generated unimaginable wealth to those who have built this business’s all of which were founded in the last 40 years and are still controlled by the first generation of owners. Again, some mean reversion is quite probable as interest rate policy becomes more normalised but these very substantial gains will provide real choices for those who have had the foresight to hold a good allocation of these technology companies in their portfolio. Equally importantly, to different degrees, all these companies have provided improved outcomes in the lives of consumers through more efficient access to knowledge and greater opportunity for self-improvement via technology. Other companies such as Netflix, Spotify, AirBNB and Uber are all going down a similar path and are proving valuable investments for your fund managers. Possibly the most contentious investment being Tesla which now has a market value greater than the traditional Detroit based car manufacturers of Ford, Chrysler and General Motors combined. The point being that in identifying global trends and adjusting portfolios to pick up these tail winds significant financial returns can be achieved.

Tesla v rest of car manufacturing market capitalisation. Source: YCharts

The Sydney property market continues to roar ahead with core data showing a further growth of 2.5% in June and 15% for the 12 months. Anecdotally, clients report frustrating experiences at auctions with prices being achieved well above reserve and the pre -approval levels for mortgages. The red tape in getting mortgages approved and the need for financial support from the bank of mum and dad is certainly exasperating and affordability issues should lead to a slowing down of growth over the next 12 months. Once overseas visitors can return, and net migration ramp up again then the oversupply of rental property in our cities should soon be filled and again we will face a supply shortage. In the meantime, the safest and easiest way to build wealth in Australia is through the long term growth in the value of the family home which remains exempt from capital gains tax on sale and can be converted into after tax super contributions when downsizing later in life (subject to some limitations). Longer term fixed rates are beginning to rise so this would be a good time to consider future funding options via our mortgage business haydn.dale@virtueandpartners.com.au

Australian Property Market. Source: Corelogic

- Low and middle income tax offset for taxpayers with income up to $126,000 (sliding scale up to $1080 rebate)

- Small company tax rate falls from 26% to 25%

- Super Guarantee increases to 10% of wages

- Work related concessional taxed super contributions increase to $27,500

- After tax annual superannuation cap increases to $110,000 (plus the three year brought forward rule)

- Pension maximum superfund balance increases to $1,700,000 (minimum drawdowns halved for 21/22)

All these measures will support the growth of active assets in the superannuation system which is currently worth more than $3 Trillion and will primarily flow into shares making future growth a somewhat positive feedback loop. The government has also tightened up the unnecessary use of multiple superannuation accounts via a ‘stapling’ arrangement whereby clients will retain their existing superfund when they change jobs unless they make an active choice to change provider. There will also be greater transparency of performance between product providers, although the real difference in returns is driven by asset allocation. Having a strong ongoing relationship with an experienced financial adviser rather like tandem parachuting allows clients to take a higher level of risk in a very low cash environment knowing that they have someone qualified over many economic cycles to circumnavigate the changing conditions which are a fact of investment life.

We have much to remain optimistic of as we go into the new financial year. The team remains absolutely focused on providing exceptional personal service and getting through the unnecessary red tape that has really handicapped the efficient provision of financial advice and mortgage broking in Australia. In the short term we are conducting most meetings via ZOOM but look forward to face-to-face meetings just a soon as we are allowed. I still see very good investment opportunities available at the moment particularly in health and technology and look forward to sharing them with you over the next few months. We are still accepting new clients and welcome referrals to fiona.goodland@virtueandpartners.com.au and as always welcome your feedback to my newsletters.

Wishing you all peace and patience at this time.

Tony