Greetings as we adjust in Sydney to this prolonged lockdown with a special welcome to our small business clients in the effected LGA’s of southwestern Sydney.

Internally, all our team members are being vaccinated, as soon as they are able, and we continue to work efficiently from home using ZOOM to communicate with clients as needed. It would appear that short sharp lockdowns will continue to be a fact of life until we reach an acceptable level of collective vaccination which may take up to this Christmas to achieve. To some extent, investors have looked beyond the next few months and based on the overseas experience, are looking to benefit from record low interest rates and a sharp economic recovery next year.

Our recent financial history, from last year where both equity and property markets recovered very quickly from the initial national lockdown, gives us a good guide as to how the next few months may play out. The community is again building up savings due to limited consumption options which should lead to pent out demand for travel and lifestyle experiences as and when life returns to normal. In the meantime, some of this forced savings is finding itself into equities and property, leading to a bidding up of asset valuations. The RBA again supported the status quo with official rates remaining at 0.1% at the August announcement.

Over the last few days, Australia had two of the largest mergers and acquisitions of all time with the $21B Santos/Oil search merger and the $39B takeover of Afterpay by Square. With the ASX at an all-time high and interest rates so low, this is a good time for successful Australian companies to use their high share price as collateral to buy out competitors. It also makes our companies susceptible to overseas takeovers as global boundaries to capital continue to evaporate, with the bid for Sydney airport from a consortium of superannuation funds being a further example. Clients are benefiting from this activity with one of our boutique fund managers, Hyperion, being a substantial shareholder of both Afterpay and Square. In context, neither of these companies have made a profit and effectively make their revenue from billing suppliers for access to clients not from customers themselves. Business models are changing rapidly, and investment strategies need to reflect this while understanding that many of these companies are fully valued by any measure and are vulnerable to significant share market declines should market sentiment change. As an example, Square share price is up 2342% over the last 5 years, and as mentioned, yet to make a profit and a current valuation of $124Billion US.

Impact of the Squarespace – Afterpay deal on the ASX

Source: AFR 2/8/21

We are now in the annual reporting season with RIO kicking things off with an extraordinary $13B dividend (equating to funding 13 weeks of the Sydney lockdown) this is a large holding for one of our managers Plato which will reflect in strong distributions to clients. At the same time NAB and ANZ have commenced a share buy-back program which will probably be expanded to Westpac and CBA reflecting a growing confidence in the capacity for clients to meet mortgage payments and supported by rapidly rising property prices.

Most companies on the ASX will report over the next few weeks, and as usual it is the outlook statements which will give analysts a guide as to future profitability next year. While there will be natural caveats over the current lockdown market expectations are for some very strong results particularly in the resources sector. All of this adds up to the ASX trading at an all-time high passing 7500 and importantly this is reflecting improved profitability from greater efficiency rather than an increase in future earnings multiples.

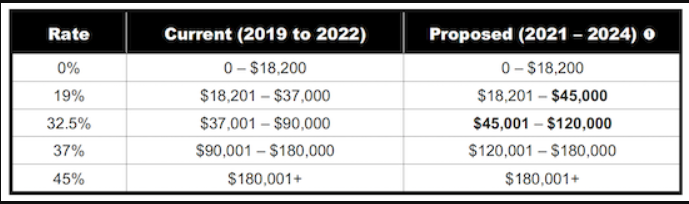

One of the reasons for this apparent optimism is the acceptance of existing tax settings by the ALP if they were to get into power at the next Federal Election which needs to be held by mid-2022. Specifically with no changes promised for Capital Gains Tax and Negative Gearing, and accepting the legislated future tax reductions for income earners up to $200k, the political overhang on longer term investment decisions has been removed, at least for the next electoral cycle. This is a very supportive environment for investors to get ahead without facing excessive future taxation, and especially when coupled with increases in allowable superannuation contributions. The main goal being to grow wealth from a multiple of financial buckets that can be converted into an income stream on retirement to replace personal exertion work in part or whole. Where capital is depleted over time, Centrelink benefits will kick in, in later life to supplement lost income. One of the important financial advice growth areas is the resurgence of reverse mortgages with improved conditions allowing capital to be repaid if chosen and allowing immediate access to the growing equity in the home, both for renovations and future living expenses. Feel free to contact me directly should you be interested in pursuing these options tony.virtue@virtueandpartners.com.au

Current and future Marginal Tax Rates

Source: ATO

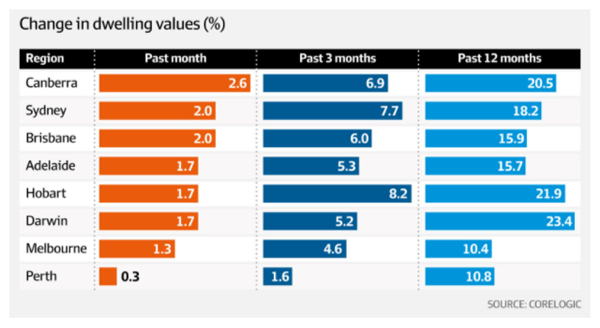

No newsletter would be complete without a running commentary on the domestic property market with Sydney rising another 2 % for the month or 18% annually. Again, tax policy really makes home ownership attractive. Supported by low interest rates and the lack of available housing, supply continues to push up prices at a level which must now be a concern to authorities. RBA Interest rate decisions are a very blunt instrument effecting both first homeowners and large corporations indiscriminately and while it may be prudent to discourage excessive residential investment property loans providing access to cheap capital for the engine room of small business operators is crucial to getting the economy restarted and firing on all cylinders. Property price growth is very much a global phenomenon with similar growth in New Zealand, Canada and the UK and a very close correlation to Australia which is to expected in an open economy. Given the current lockdown it would be a brave Government to tighten up access to capital or increase interest rates via the RBA prior to next year’s federal election. This additional equity with on aggregate is approaching $2Trillion nationally, will provide a growing buffer to convert into income streams as the population ages. From a regional point of view, Brisbane having just been awarded the Olympic Games in 2032 looks to be the pick of the pack for residential property options.

Residentioal Property Growth

Source: AFR 2/8/21

Comparable Global growth in Residential Property

Source: Bloomberg

As we lean into our 6th week of lockdown here in Sydney, we understand that many of you at home are juggling multiple commitments, such as your own job and home-schooling, and missing your extended loved ones. We are mindful of all the challenges that this presents, and we are here to offer support where we can. From talking to many of you, we hear that the coverage from the Olympic Games has been a welcomed distraction, with some exciting finishes and amazing achievements by team Australia. A great display of tenacity, perseverance, and grit.

Thank you for your support, and we appreciate your referrals. We look forward to seeing you in person, just as soon as we are able to.

With our best wishes,

Tony and Fiona