Greetings to you all after another momentous month!

A particular welcome to our Melbourne clients who, last week lived through the biggest earthquake in 50 years, a very sobering reminder of how tenuous life can be. At this stage, the race is on to hit a range of vaccination targets for the country with both Victoria and NSW in various levels of lockdown for the next few weeks, but with the hope that we will be back to some level of normality by Christmas 2021. Circumstances like this have been faced by many generations in the past and force us to stop and reflect on what really does matter in our lives.

Business Practices

We continue to be as busy as ever working predominantly online and indeed the current adversity has led to new and more efficient business practices across the financial services sector. Managing change and new technology can be daunting and stressful and can only be achieved at a speed that the community can adjust to and as such, part of our job is to sensibly balance efficiency with good old-fashioned face-to-face personal service. As a practice, we are looking forward to seeing clients in person and at this stage, the Xmas Party at the Manly Skiff Club is booked and most definitely on!.

Market Overview

Chinese Property Market

Turning to the markets, as ever there are good and bad things happening at the same time, and a level of maturity and perspective is needed to not be overly driven by the news which is often more interested in their advertising revenue than the accuracy of their reporting. One of the current concerns revolves around the Chinese Property Developers personified in a company called Evergrande. This is not a new scenario and we have had previous issues with HK-listed property companies over the last 30 years. In essence, the Chinese People Party (CPP) operates in a strange partnership with their private sector to keep their economy expanding rapidly and is now fast approaching the US as the largest economy in the world. This has allowed Chinese property companies to expand rapidly utilising funding from State-controlled banks at a level that would not generally be regarded as prudent in the Western world. The extraordinary capacity to build new cities from scratch and respond to the coronavirus with additional hospitals built in a few days shows what can be achieved at speed in a centralised economy.

Evergrande

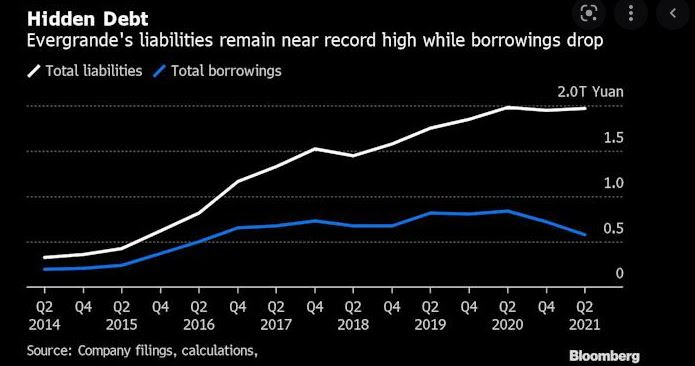

Source: Bloomberg

This strategy encourages overbuilding which may take several years for demand to catch up. According to reports, the construction of unfinished properties represents the floor space of three-quarters of Manhattan, which is troubling particularly for the everyday Chinese purchaser of these properties. The Government however, can step in, liquidate companies, sack and ‘severely punish management’ and nationalise companies and fund completions as needed. Evergrande does have a number of bond issuances available to investors in the Western world which is why this is getting greater publicity and at this stage, the Chinese Banking sector has extended further credit to meet these immediate obligations. The most likely scenario for the Chinese Property Sector is a tightening of credit for new projects but the completion of existing ones, even if this means that shareholders’ values are wiped out through forced closure. While Evergrande is the largest of these property companies there are a significant amount of smaller competitors leading to a concern of a domino knock-on effect. As in other parts of the world, the value of property assets has grown substantially in the last 24 months leading to increased speculative investing rather than primarily purchasing for a long-term home to live in. So look for a sharp tightening up of credit in China rather than an uncontrolled marker meltdown which would adversely affect the 1.5 billion citizens of China, many of whom remain very poor living in the countryside. China has a history of re-educating entrepreneurs who step outside of their guidelines as evidenced by Jack Ma and Alibaba.

“As China Evergrande Group fights for survival under more than 1.97 trillion yuan (US$305 billion) of liabilities, speculation is mounting that a painful restructuring is inevitable. The stock has plunged 82% this year, wiping out almost $US20 billion of value, while its offshore bonds are trading at distressed or near-default levels” South China Post 24 Sept 2021

Iron Ore Prices

Domestically the price of iron ore has fallen significantly due to the Chinese, as our largest customer, slowing down their property sector and hence the need for steel. That said we have just had a record dividend season with the three main minors paying very substantial distributions and even at $100 per tonne, Australia still produces the best iron ore in the world very profitably. The supply/demand dynamics will recorrect and clearly, we need to avoid having an over-reliance on one market. The current meetings in the US of our Government extending relationships with Japan and India are good examples of diversification. The upgraded relationships with the US and the UK sharing technology findings should again be a positive in the ongoing development of our trading options and lead to further export opportunities and a more integrated investment market between the three countries. The reality remains that the world is highly integrated and markets correlated. Whilst retaining independent thought we need as a country to be fully engaged and drive the agenda with our international partners. Markets can quickly change their sentiment and any contagion effect in one part of the world can spill over into other comparable markets, with the effect of coronavirus on market distortions over the last two years being an obvious example.

Year-end Reports

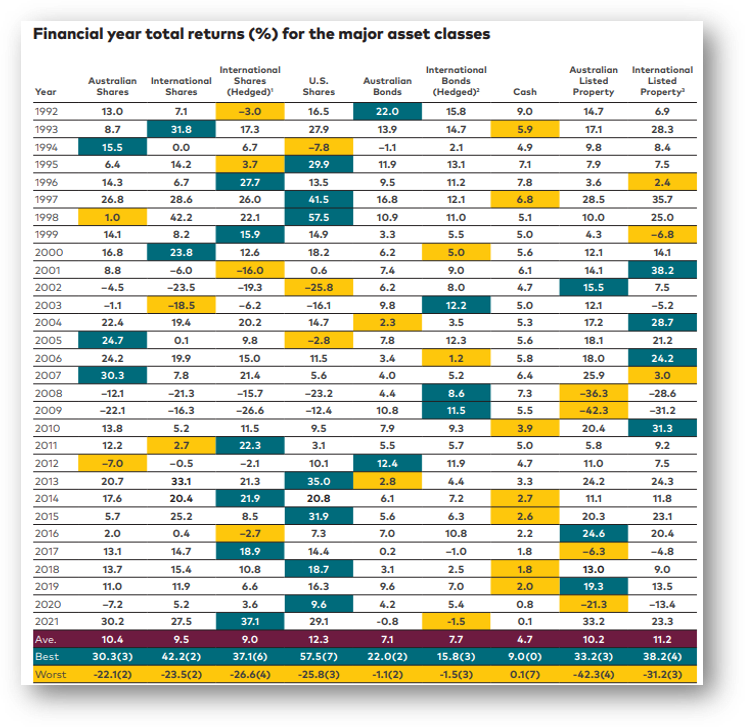

Year-end reports are currently being sent to clients showing a very strong 12-month performance, particularly for Domestic and International shares with returns approaching three times the longer-term mean. It is highly probable, markets will at best have an average year ahead, with declines of 5/10% which is quite healthy in a fully functional market. Governments of the world will try and target a “Goldilocks economy not too hot or cold” and will be reluctant to increase interest rates until all other monetary policy options are exhausted. Both the RBA and the US Reserve have reduced their monthly bond-buying activities which had the effect of driving overnight interest rates down and it is now only a matter of time before APRA introduces tighter lending criteria to our banks to try and slow down the rapidly growing property prices in our community. So hopefully a period of stability moving ahead accepting a fee road bumps and on the upside, a possible roaring 2020’s emulating the roaring 1920’s after the recovery from the Spanish Flu.

Vanguard Results June 2021

Source: Vanguard

We all very much look forward to getting back to some normality soon and seeing you face to face. In the meantime do check website www.virtueandpartners.com.au or contact us at info@virtueandpartners.com.au

With our best wishes,

Tony and Fiona