Greetings as we come into Spring and warmer weather,

Australian Equities

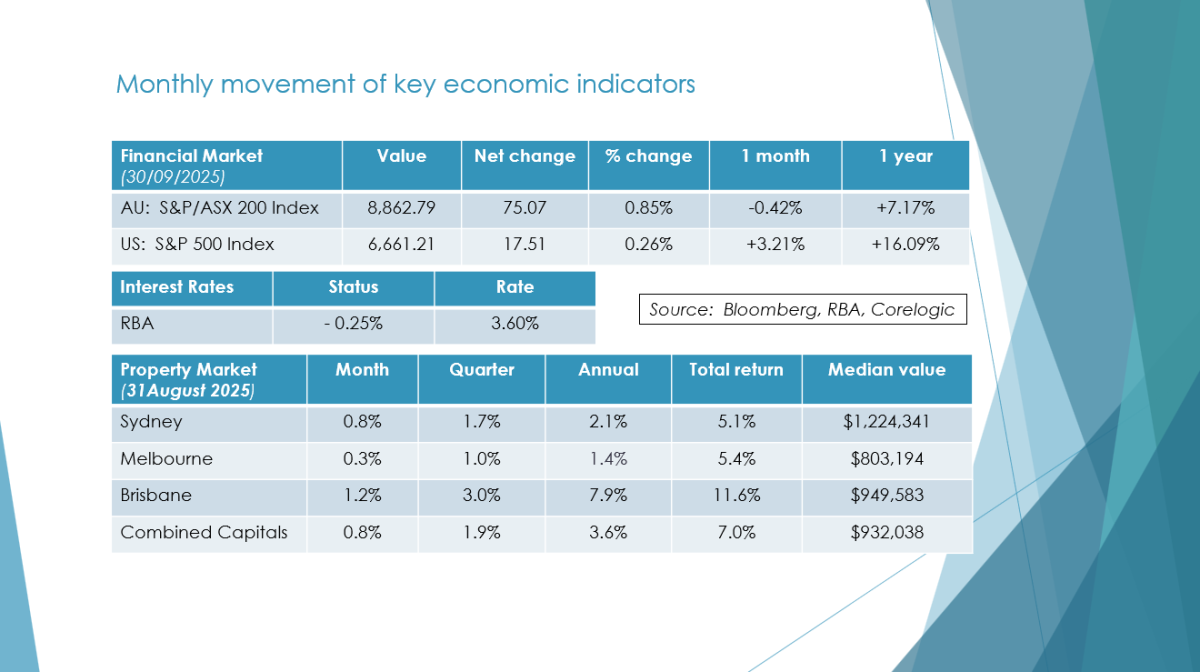

As anticipated the RBA kept their interest rates at 3.6% at their meeting yesterday. There is an expectation that rates will drop in November by 25 basis points. The intention being to get a balance between encouraging further investments and avoiding exuberance, and excess returns in the market.

A quieter few weeks on both the Australian and U.S. share markets as investors took stock of recent gains, with the markets tracking sideways. Avoiding investment exuberance is important in a market reaching new all-time highs, as investors consider the effect of artificial intelligence in reducing the costs of businesses, hence improving their profits, combined with the general trend to drop interest rates around the world, which has the effect of reducing the borrowing costs of business and then making equities more valuable relative to fixed interest returns. Underpinning our domestic market is a very significant amount of dividends paid, with the majority being fully franked from our largest top 20 companies, which underpin much of the income streams that clients need to live off at the retirement phase of their lives.

With around 25% of the overall superannuation pool, which now equates to $4.3 trillion, being in the drawdown phase, the need for sustainable and reliable income streams to support allocated pension payments becomes more relevant than ever. It also makes higher paid dividend yield stock increasingly attractive, which is reflected in the share price, of which CBA remains the standout. With contributions of $4 billion a week going into the superannuation market from employer contributions, and a very limited pool of money to invest back into the Australian component, this is underpinning any potential downside in the future trend of the Australian equity markets.

One of the safest ways to pick up these dividends is through income-paying managed funds, who are rotating their investments around to collect as many dividends as possible over the full year, while avoiding the dividend traps of companies paying a high dividend now but getting into difficulty later. This is particularly relevant when markets are at highs, and there may be a downturn in the value of shares but not the income stream paid from dividends and is something that we favour at this stage of the market cycle. There are also a number of exchange traded funds (ETFs) that focus on maximising these dividend yields, which we are also supporting.

At this stage of the cycle, smaller companies should begin to catch up their valuations on the larger ones, and there are specific fund managers specialising in this area that should do well in these market conditions, which are strong for merger and acquisition opportunities, where companies are bought at a significant premium of around 40% to their current share price.

Comparison of small and larger companies P/E ratios

Ultimately, all types of governments, irrespective of their political flavour, seek to have robust growth in the economy in a sustainable manner, where there is the feel-good factor of investments improving and hence wealth going up steadily over time. There is effectively a “put option” that when markets do get into difficulty, central banks drop interest rates to make life a little bit easier for business to access cheaper capital and hence improve profits and valuations.

International Shares

Again, dominated by the Magnificent 7, but with the potential for the wider market to benefit from this technology to improve their own profitability and hence share price. There are a number of innovative fund managers and ETFs utilising “put options” over their share prices to generate an income stream on a monthly basis, which is assisting in producing a more consistent income stream for clients. I think this will become more relevant in portfolio constructions as Australian investors get more accustomed to a higher level of income from international shares. The derivative market in the U.S. is far deeper than Australia and hence there is a real opportunity to generate income of around half a percent per month from these options. At this stage, JP Morgan is probably the best bet and one of the largest banks globally.

The market seems to have taken the tariff-related Trump pronouncements in its stride at this stage and is reverting back to the genuine earnings from these larger companies, which at this stage are achieving investor expectations. Again, at the heart of this is using technology to reduce costs of business, rather than any significant increase in revenue. Subscription businesses like Spotify and Netflix are benefiting from their stronger market power to increase fees, as is Microsoft, Google, and Facebook, all of which is now dropping into their bottom line.

Australian Listed Fixed Interest

A combination of the bank hybrid market running off in 2031 due to APRA intervention and term deposit rates falling as the RBA drops interest rates has reinvigorated the direct fixed interest investment market on the ASX. There are plenty of direct investments coming to market with a yield of at least 6% with investment-grade assets. We do get access to most of these listings and, particularly for wholesale clients, look to lock away sustainable income in a safe manner through buying these investments on a direct basis. Providing fund managers retain their discipline in purchasing underlying investments that have a significant margin of safety and avoid construction finance, this sector should grow and become more relevant in investors’ portfolios.

Overview of Wealth In Australia – Asset Class

It is valuable to reflect on the overall asset position of the country at this time by asset class, which really shows just how wealthy the country is in aggregate, based on the growth particularly of residential property, but also Australian shares over the last 20 years. While this is far from equally dispersed, it does show that in aggregate, assets are growing quickly enough to meet the income stream needs of those in retirement, providing money is managed prudently. It is also a stark reminder that owning your own home makes a massive difference to your likely financial position at retirement. It remains one of the top priorities of the business to get people into their own homes at as young an age as financially possible. We offer a full mortgage broking and property access service to assist in achieving these goals. More recently, the growth of clients downsizing into smaller, easier to live in properties and using the access to bump up their super is becoming more and more common. You should budget on an income stream of 5% in most market conditions as a base case for drawing capital down, so on $1,000,000 this would equate to $50,000 a year without drawing down on the capital. With the family home paid off, this is a sustainable position and sits just below the asset base for a couple with a family home from receiving any Centrelink benefits.

Domestic Property

With the supply of medium-density property still very limited and a few years away, it is unsurprising that residential property prices are growing quite significantly in most of our capital cities. The Federal Government has introduced a 5% deposit option for first-time buyers up to a certain threshold, which should encourage the public currently renting to purchase their first home and should be good for the wider economy. It is, of course, in the political interest of all parties for properties to grow in a sustainable but not excessive manner, targeting a capital growth of 6 to 8% per annum through the full market cycle. Over time, this reduces the debt-to-equity ratio of property investments, which should reduce over time as the equity grows. In Sydney, there is a significant push to increase the provision of medium-density housing closer to our train lines, and we are certainly seeing a revaluation of areas such as North Sydney. So, in aggregate, anything close enough to the city where you can work in a hybrid fashion is very attractive, and with interest rates falling, the cost differential between owning and renting is becoming much closer.

Rolling annual change in Australian dwellings

Our News

We had an excellent client function at the Harbord Diggers last week focusing on estate planning and the reality of a very substantial amount of money transferred between the generations over the next 25 years. Due to obvious demand, we will run a similar version in the city later this year. Before you know, it will be Christmas, and we will again have our function at the Manly Skiff Club for our local clients, with something similar in the city.

Reflecting the growth of the firm, we have several new support team members working now in the Manly office and are in a position to take on a number of new clients. Our first priority is to look after the extended family of our existing clients, including their close friends. We see each day the practical benefits of good ongoing financial planning advice in our community and seek to help as many as possible, which contributes to the economic stability of the economy in our area.

A reminder that we have much more detailed financial advice of a general nature on our website www.virtueandpartners.com.au and initial enquiries can be made at info@virtueandpartners.com.au

Sincerely

Tony and Fiona

Please note this newsletter is of a general nature only. Click to our websiteABN 42 060 673 814 • AFSL No. 407238