Greetings from a wet Sydney,

Current Investment Markets

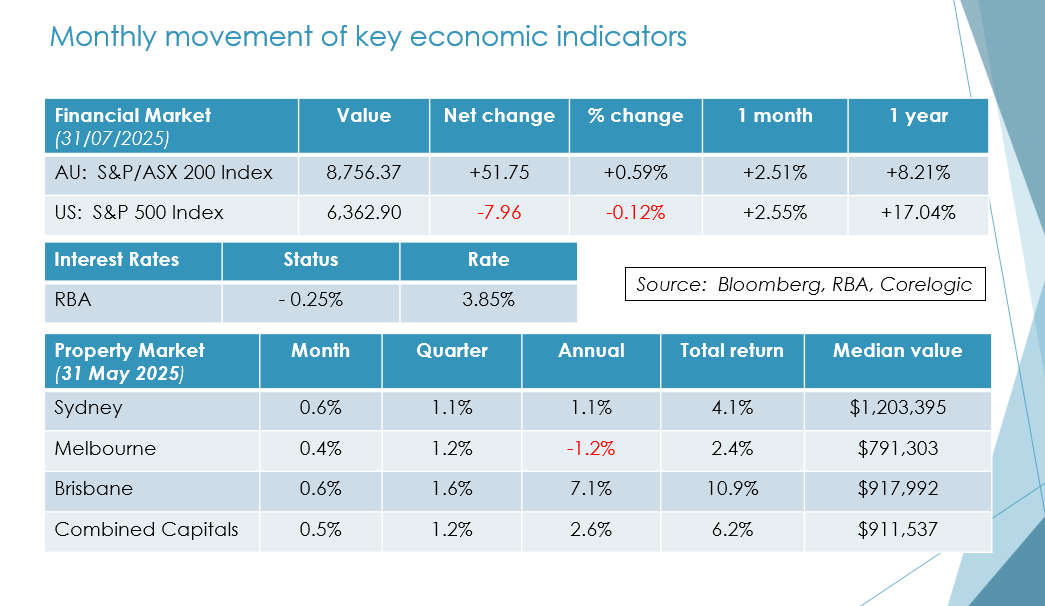

Both equity and property markets remain quite strong at the moment with the prospect of interest rates dropping. The CPI came out this morning at 0.6% for the quarter and 2.3% annually, slightly below expectations and it is now highly probable that the RBA will drop interest rates in August. In hindsight the RBA probably would have been better to have dropped rates in July, and it is frustrating to get the timing of information organized in a way that we can make the correct decisions as a community in real time. The Australian Bureau of Statistics have now indicated they’ll release this data monthly which should make life a little easier.

Falling interest rates are a double-edged sword which while helping mortgage payments reduce the guaranteed interest returns for retirees. There are a number of interesting options coming to the market at the moment to try to bridge this gap and we are working carefully with providers to get a higher level of interest for you without taking unrewarded risk or locking up capital longer than is necessary.

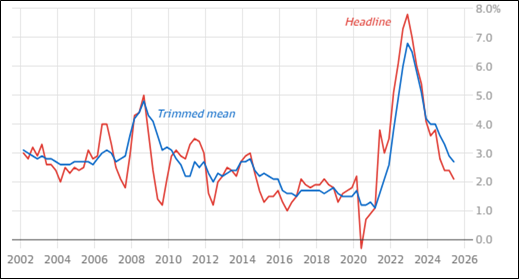

Annual Inflation

Source: Australian Bureau of Statistics, RBA

Australian Earnings Season

This week marks the start of the important annual earnings season for Australia where all listed companies with a financial year end of the end of June will need to report by the end of August. Equally important as the result is the future guidance for next year’s prospects, which will in many ways guide the future share price of companies. While our larger companies, particularly the banks, are well covered by analysts smaller companies should do well in this market, and this is where active fund managers should be able to generate improved returns for investors. As usual we will be monitoring these results very carefully and advising affected clients if there are any adverse results that come onto the market.

Australia operates a continuous disclosure obligation to the ASX to immediately report any prospective earnings being 15% below consensus and as such there have been very few companies reporting adverse results in the confession season prior to the August reporting. The equity market in Australia is currently close to an all-time high and characterised by very few new capital raisings which is to some extent forcing share prices up particularly with the $4 billion a week superannuation contribution coming into the market from the 12% work related super. So, nothing looks particularly cheap but at the same time this is generating a strong level of dividends and franking credits for clients to live off and we will continue to invest based on our model portfolios at around 40% into Australian equities for our balanced portfolios.

Trump’s Tariffs

One by one Trump seems to be coming to agreements with trading partners over increased tariffs but certainly not to the level he initially tried to enforce back in March. In essence this is a basic tactic of asking for far more than is viable and then negotiating back. Markets seem to have taken this in their stride and interpreted this as a slight movement of the needle back to US manufacturing but not enough to really cause stability in the wider markets. Australia has yet to finalise tariff arrangements with Trump and no doubt there’ll be some further negotiations particularly in the media and pharmaceutical sector before they settled down.

In the longer term, it is in the world’s interest for each country to produce the products and services it is best able to, with as few constraints as possible, and export them to the countries that need them most. When markets get distorted there’s inevitably a future time when a reckoning appears and this can severely dislocate markets as we saw earlier this year. The US 10-year bond market remains below 5% which is a key indicator as to the risk of a future recession and it’s something that we look at on a daily basis. To be clear tariffs are inflationary as it increases the cost of purchasing products and is one reason why the Federal Reserve is holding back in dropping interest rates in the US.

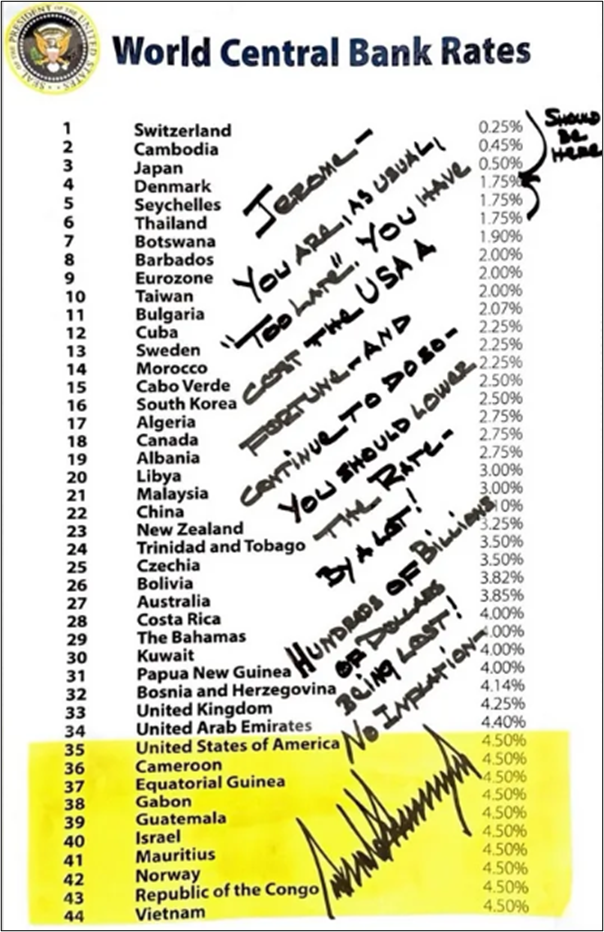

Trump has been at pains to show a graph of the relative interest rates in the developed world and the fact that the US has one of the higher rates relative to comparable countries showing the US Federal Reserve have the capacity to drop rates over the next few months. The main take out for me is the similarity of rates around the world showing the interconnection between countries.

Real Interest Rates by Country in 2025 (Trumps annotated diagram of comparable countries)

Source: The New York Times

Application Of Technology

The use of AI is now becoming a daily event for all of us and the new technology will take time for us to settle down particularly in relation to security and access matters. On the positive side AI can assist in quick diagnosis of medical and financial matters and providing the right guard rails are put in place should really improve efficiency within the Australian economy. It does mean that we all need to continually upskill and be relevant in our work and this will be a challenge for the community to adjust to. One of the obvious positives is releasing people to have more time away from work to develop hobbies and stay fit and healthy and it will remain a delicate balance as to how intrusive we allow AI to become in our daily lives. From an investment point of view NVIDIA which is the largest of the AI providers, is now the highest value company in the world. This can of course change quickly and overnight Novo Nordisk, who manufactures Ozempic and was the largest European company on the stock market, fell by 30% on a poor earnings result. In contrast Microsoft was up 7.5% overnight and Google (Alphabet)10% on strong quarterly earnings showing the impact of AI on their results.

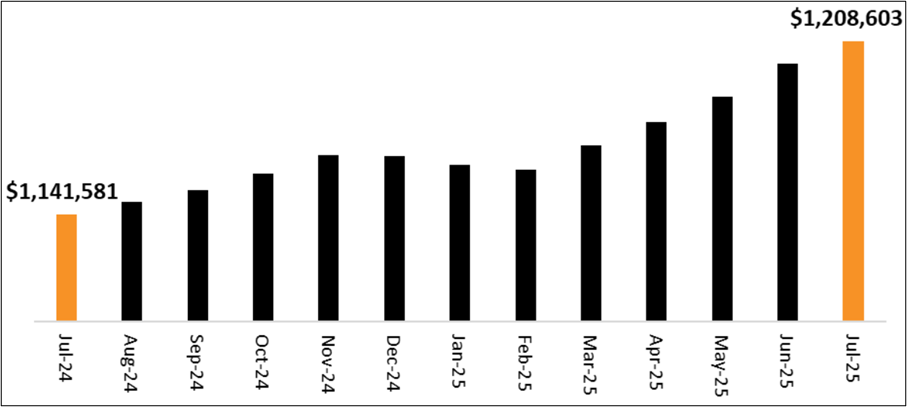

Australian Residential Property

There’s been an expectation of interest rates dropping for quite some time in Australia which will allow for further housing to be constructed, existing property prices to go up in value and the additional equity then to be redeployed into further investments. The residential property market is by far the largest asset class in Australia and with the principal place of residence remaining capital gains tax free a very obvious investment for clients at as younger age as possible. The Federal Government is introducing new rules from the 1st of January 2026 to allow first home buyers to purchase with a 5% deposit and in general the mortgage insurance market has now ceased to exist in Australia whereby a significant premium used to be paid to an insurer if your deposit with less than 20%. This is positive for the market and we now need to address Stamp Duty in all States to ensure that purchasing a property is a viable option for as many people as possible.

The residential market is increasingly including downsizes and supporting children and grandchildren and it’s very much intergenerational now as far as funding goes. Net migration and in particular short term student visas remain far more than what have been budgeted for which is soaking up much of the demand in inner Sydney and Melbourne. The NSW Government is encouraging medium density development close to our train stations and really the only way is up not out as far as expanding in Sydney. Through our property interests we do have access to several excellent developments which is an opportunity to get into the market as quickly as practicable with more favorable interest rate markets.

National Quarterly Median House Price

Source: My Housing Market. Latest Housing Market Stats Dr. Andrew Wilson

Our News

Demand for independent financial advice is at a very high level now throughout the country. We have increased our staffing level so that we can effectively service a larger number of clients in our community.

As a referral-based business, we rely on good introductions to suitable potential clients who really will benefit from our services on an ongoing basis. Please feel free to make an appointment by emailing us at info@virtueandpartners.com.au or by visiting our website at www.virtueandpartners.com.au.

There are videos on our website which is a good introduction to the key advisors in the business, and we continue to support a number of local charities and functions to introduce potential clients to the business in a supportive environment. Do feel free to introduce your extended family; we are particularly concerned about looking after the next generation of children coming into the workforce. We are also organising an estate planning seminar in a few weeks’ time to try to deal with the vexing issues of intergenerational wealth with invites to follow.

We very much look forward to the future with confidence.

Sincerely

Tony and Fiona

Please note this newsletter is of a general nature only. Click to our website

ABN 42 060 673 814 • AFSL No. 407238