Good afternoon to you all, as we come into Spring and hopefully leave Winter behind, here is our latest market update.

Australian Share Market

The annual earnings season has now concluded, and results were mixed. The health sector in particular struggled, with CSL, Ramsay, and Sonic all down over 10% on their results. The banking sector held up well, with dividends remaining similar to previous years.

In aggregate, the main theme was the growing use of artificial intelligence to reduce costs, while top-line revenue remained subdued at best. Coles performed well, while conversely, Woolworths was punished for poor results.

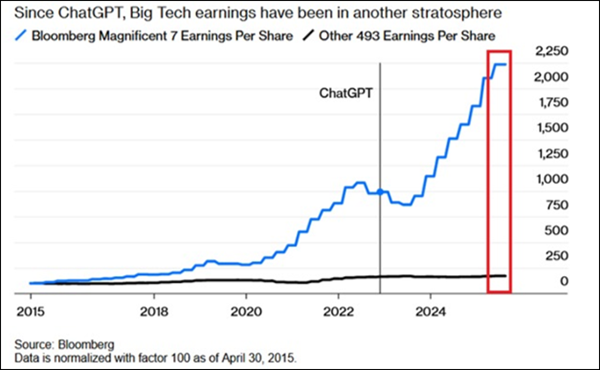

Equity markets as a whole appear fully valued at the moment, and we must be mindful that a pullback of 5% to 10% would be quite normal under the circumstances. To some extent, the Australian equity market has been pulled along by the high performance of the “Magnificent Seven” in the U.S. market, which again reflects the valuations driven by artificial intelligence in companies such as Nvidia and Microsoft.

The key now for Australian companies is to reduce costs by effectively utilising AI as a more efficient way of operating their businesses.

Much of the current growth is occurring in the small-cap sector, and there is a growing amount of mergers and acquisitions happening – where we see real potential for future improvements in company performance. The quickest way to access this opportunity is through small-cap managers, and we have strong access to top-performing funds in this space.

Falling interest rates have also positively impacted sentiment and made the cost of borrowing to acquire other companies cheaper.

There has been a dearth of new company listings on the Australian Stock Exchange, with many now choosing to remain private. This has led to a shortage of potential investments. With the 12% Superannuation Guarantee now mandated for all employees, this has led to further inflows – primarily into large-cap companies, including the major banks. ANZ, Westpac, and NAB have followed CBA to record-high share prices.

To some extent, this puts a natural floor under the domestic stock market, which still remains heavily driven by sentiment and expectations of further interest rate cuts.

Australian Earnings Season Executive Summary (Aug 2025)

International Equity Markets

The U.S. equity market continues to reach new highs, although growth is largely concentrated in just seven major companies. Nvidia remains the most expensive and highest-valued company in the world.

A worrying development is the Trump Administration’s policy of taking equity positions in certain companies without paying for them – the rationale being that these companies benefit from dealings with China, and some of their profits should be repatriated to the U.S. government.

This is effectively a different mechanism – rather than tariffs – for the U.S. to gain revenue. The outcome is the same: helping to reduce national debt and support tax cuts. This does appear to be a deliberate policy, and it may be expanded to other U.S. companies that import heavily from China. Essentially, the U.S. public is gaining a “free carry” on the success of its most profitable companies – without investing directly.

Historically, the U.S. market looks fully valued. Again, we should be prepared for a pullback of 5% to 10% from these highs at some point.

On a positive note, the actual benefits of using AI should enable more companies to reduce their cost base, improve profitability, and in turn, lift share prices.

Magnificent Earning Growth

Australian Inflation

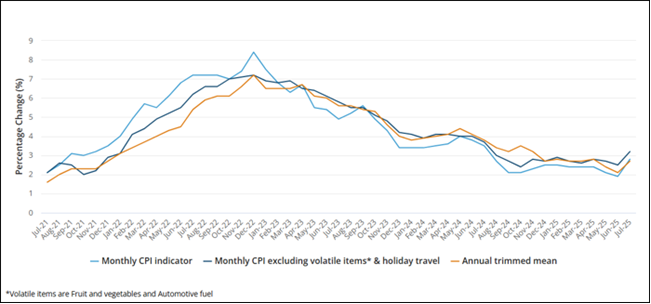

The latest monthly inflation numbers showed a notable increase, primarily due to rising energy costs following the removal of government subsidies.

It is possible that this will prove to be an outlier, and the quarterly inflation data – due later this week – may smooth out the picture. Until this becomes clear, it is far less likely that the RBA will cut interest rates before Christmas.

The rolling 12-month inflation figure remains below the RBA’s 3% target, but the latest uptick is an unwelcome development. The RBA remains focused on ensuring inflation does not break out before moving to further rate reductions.

Energy costs remain a major expense in the Australian economy, particularly as we transition to more renewable energy. Over time, we are seeing a significant reduction in costs – particularly in solar – but a more coordinated national approach is required to achieve the kind of efficiency now common in Western Europe.

All groups monthly CPI indicator, Australia, annual movement (%)

Source: Australian Bureau of Statistics

Deeming Rates

The Federal Government has announced an increase in deeming rates of 0.25%, effective from October 1.

This will increase the assessed income for retirees under the income test, potentially reducing their government pension. To mitigate this, we are supporting a number of fixed-interest investments performing strongly and well above the deeming rate.

The key here is not to leave too much money in overnight bank accounts. Instead, we encourage you to work with us to maximise returns on funds not immediately needed for living expenses. The new deeming rates are as follows: From September 20, 2025, the new deeming rates will apply to financial assets for government support payments: the lower deeming rate of 0.75% applies to the first $64,200 of assets for singles or the first $106,200 for combined couples assets, with any assets above these thresholds being assessed at the 2.75% upper rate. These changes will affect income calculations for payments like the Age Pension.

In essence, the Federal Government is encouraging retirees to more actively manage their money.

Domestic Property

The Federal Government has announced that the 5% deposit scheme for new investors will commence from October 1, which should stimulate the property market.

Heading into spring, we expect an improvement in property values, with August data already showing momentum – particularly in Sydney. The reduction in interest rates is improving affordability, and APRA is adjusting its lending calculations to support first home buyers – including greater flexibility around HECS/HELP debt.

From a financial planning and security perspective, the best thing we can do for the next generation is help them into home ownership. This is a major focus within the firm.

We have access to many high-quality developments and can secure pre-approvals quickly – providing greater certainty for clients entering the market.

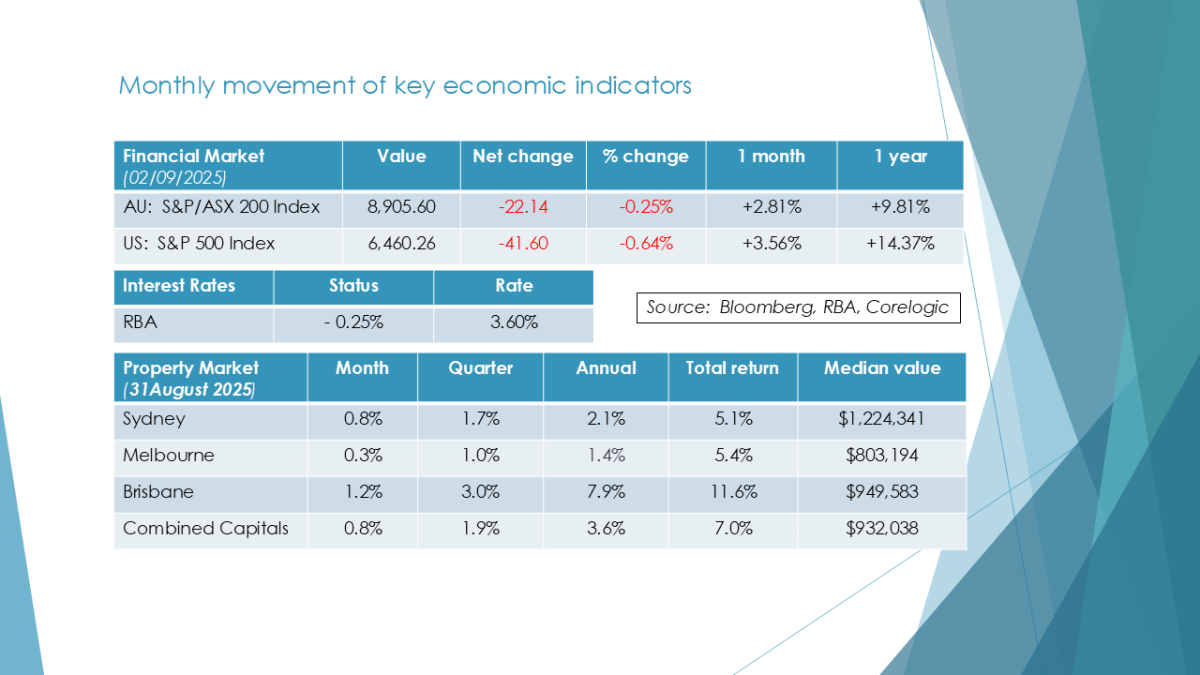

Change in medium house prices, August (%)

Source: Cotality

Our News

We continue to run a number of client briefings. Our next session is on Thursday, 18th September, covering the important and often complex topic of wills and succession planning.

There is a significant amount of wealth in our community that will need to be transferred to the next generation. We want to ensure this is done fairly, efficiently, and in a legally enforceable way. You can register directly at: manlyvandpstaff@virtueandpartners.com.au

We’ve also expanded our team to better serve the next generation. We encourage you to invite your children to meetings and help them start investing as early as possible.

Thank you for the referrals that continue to come through – they are the lifeblood of our practice.

Good independent financial planning advice makes a significant difference to financial security and confidence. We are here to assist your family and friends in navigating the many moving parts involved in the successful management of wealth.

Sincerely

Tony and Fiona

Please note this newsletter is of a general nature only. Click to our websiteABN 42 060 673 814 • AFSL No. 407238