Greetings,

A mid-month update to summarise events leading to the recent market volatility and how this may play out over the next few weeks. I did mention in the last newsletter, two weeks ago, that both the Australian and US markets had reached new all-time highs and that a pull- back of 5-10% would be quite possible based on previous experience (newsletter dated: 14/02/2020 “Overtime we must expect some mean reversion and a correction of 10% is perhaps overdue”). Generally markets need a catalyst to do this and in this case the Coronavirus originating in Wuhan China and the economic effect of efficiently quarantining a significant manufacturing province, led to a difficult few days with most equity markets declining 10% (or around 3 months previous growth).

The daily new cases in Wuhan appear to be quickly subsiding according to published data in the South China Post with over 50% of patients now released from hospital. “In context by late 2019 the population of China was 1.43 billion people: over 250,000 lost their lives on Chinese roads, 6,500 pedestrians, around 60,000 people drowned yet the death toll from COVID-19 is est. 3,000” (Source MM 5th March 2020).

As in any epidemic, quick and effective action to reduce secondary infection is crucial but this does have a short-term economic consequence due to people being unable to work effectively and thus impacting on global supply chains. The virus has spread globally with most acute and concentrated infections centred in South Korea, Iran and Italy. While there is unhelpful speculation in social media that infection levels may get worse in the short term the Chinese experience of rapidly declining infections and a very low mortality rate for healthy citizens is the best guide as to how this will play out globally.

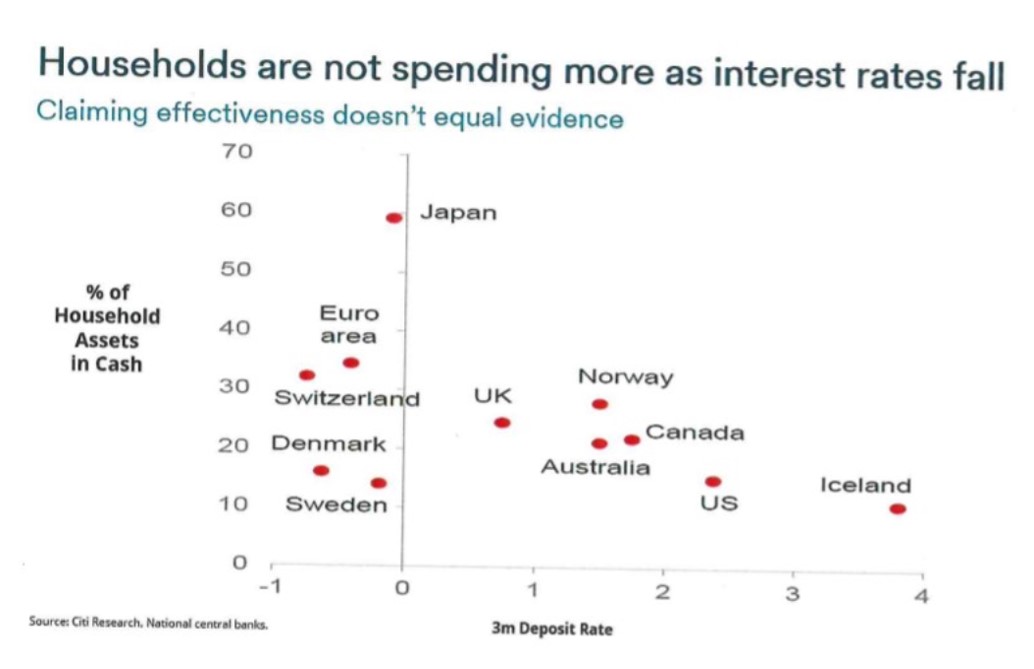

In a coordinated global attempt to mitigate any economic downturn and to support equity markets Reserve Banks around the world dropped interest rates with the US cutting 50 BP for the first time since 2008. Locally rates dropped by 25BP to 50BP with our Reserve Bank Governor Philip Lowe stating that the maximum further rate reduction would be a further 0.25% before using other tolls such as quantitative easing to support the economy. The reality is that with interest rates being so low this will have minimal effect on the consumers purchasing decisions outside of speculating on investment property while really hurting retirees who are being forced up the risk curve to provide a reasonable income to live off. The graph below shows just how much money is being held in cash around the world.

Artificially low interest rates, which reduces the risk-free investment rate to close to zero and hence the discount rate for valuing companies has limited effect and becomes a bidding war globally between competing international jurisdictions trying to get their exchange rates as low as possible to improve their competitive advantage. More useful are targeted Government responses to effected industries such as tourism, international student education and exports to China. We are anticipating a targeted response imminently once the true situation can be properly assessed. Meanwhile, some good news is our GDP for the December quarter was 0.5% better than expected and should provide adequate ammunition for a targeted stimulus program.

Markets are volatile with the US achieving a 1300 point bounce on the Dow on both Monday and Wednesday night. The Democratic nominee appears to be Joe Bidon based on the Super Tuesday results, which may positively influence market sentiment. At this stage we are holding off making any major asset allocation changes until things settle down and a stable pattern emerges. Selling an asset requires a second decision of when to re-enter the market and is fraught with timing risk and new information which would change the decision making.

We are obvious working long hours and are busy with client contact but things remain calm and markets should stabilise in the not too distant future.

If you do have any concerns feel free to contact me personally at www.virtueandpartners.com.au or info@virtueandpartners.com.au

Sincerely,

Tony