Greetings as we leave winter behind!

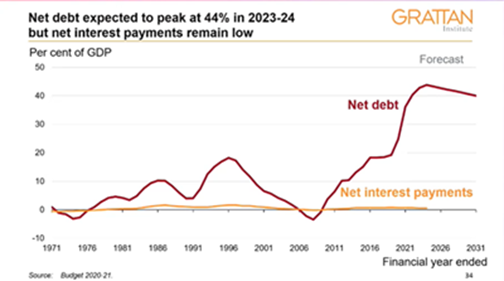

We have been digesting various market commentaries on the delayed Federal Budget delivered earlier in the week. As anticipated, this focused primarily on getting Australia back to work after the disruption to our economy caused by the Coronavirus. The corner piece of the budget was substantial support for viable business‘s which should lead to a reduction in unemployment and a return to a growth for the economy next year. While this will mean the Federal Government will incur some very substantial debt, the RBA has been raising adequate funding with 30-year bonds below 1%. So on a global bases our future interest bill remains manageable. A precedent for aggressive monetary (low interest rates) and fiscal policy (lower taxes) was the British economist Maynard Keynes in the mid 1930’s as a response to the economic depression of that era. In essence this is predicated on the ‘multiplier effect’ of Government stimulus feeding through the economy encouraging business to employ more staff who will then spend their wages on goods and services. Over time this expands the economy and is preferential to paying high unemployment benefits (effectively non-productive money). The full breakdown of the budget is summarised in the link below and is also available on our website www.virtueandpartners.com.au.

As part of this fiscal package, reductions in personal tax obligations have been brought forward and indeed backdated to 1/7/2020. This means that most Australians will be paying less personal tax and will receive a credit for tax already deducted from their income. This again is designed to encourage spending in the economy which should again feed through to higher company earnings. Companies will also be incentivised to employ younger Australians via a wage subsidy to replace the Job-keeper arrangements which is expected to conclude in March 2021. The primary goal now of Government is to have policy settings to reduce unemployment to below 6%. This will also be supported by minimal interest rates for the foreseeable future with the official rate expected to reduce from 0.25% to 0.10% at the November RBA monthly meeting. The Government has also intervened in the Responsible Lending Regime making borrowers more responsible for their decisions while reducing the red tape of getting a loan approved. Responsibility for supervising these arrangements has been moved to APRA (replacing ASIC) and in general, clients should be able to access a higher level of mortgage facilities in a timelier and less intrusive fashion.

At this stage our domestic share market has responded positively to the Budget and the prospects for the economy next year in part due to improvements in the Chinese economy our largest export market which is now anticipated to grow at 8% next year.

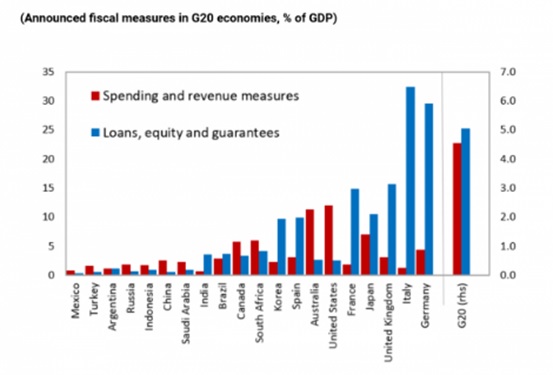

Similar policies have been enacted globally with the total amount of global stimulus approaching 9 Trillion USD (source – IMF). The graph below shows the phenomenal amount of stimulus pumped into the global economy at a time when interest rates are also at a record low. The goal being to get global economies back to optimum efficiency as soon as possible, as soon as it is safe to do so. While Australia appears to be returning to normality (with the obvious delayed recovery in Victoria) other countries including the UK have suffered from a significant second wave of the virus which will delay their economic recovery and potentially cause quite serious community unrest as they move onto their own winter period.

Graph of Global Stimulus by Major Economies (Source: IMF)

The US Presidential Election is now less than 4 weeks away and the news that Trump had contracted the Coronavirus and taken to hospital caused concern to markets although at the stage he appears to be recovering and discharged accordingly. The cut and thrust of the campaign over the next few weeks may cause some volatility in equity markets with polls consistently leaning to a Biden/Democratic win. One thing that has become increasingly apparent is never pre-suppose a particular result and factor in that that there should be enough checks and balances between their three levels of Government to avoid any major changes in policy. The reality is that the challenges of getting the US economy back to optimum efficiency and reducing unemployment will be the top priority for whoever wins the election. Indeed, the US equity markets and in particular the technology sector continues to power ahead with new markets in Artificial Intelligence and Blockchain Technology quickly being commercialised into viable profitable organisations that can attract substantial financial backing.

Turning to our property market, there have been solid auction results in Sydney over the last few weeks and the owner occupied market seems to be holding up in most suburbs. Much of the dislocated workforce in our community including international students are predominantly in the rental pool so the investment market will be subdued as vacancy rates have risen and in some cases rents renegotiated down. Clearly it is in the NSW State Government’s interest to get the economy bouncing back strongly so expect some further incentives in the State Budget next month to encourage property investing. The Federal Government scheme to guarantee first home buyers loans and thus reducing deposits to 5% has been expanded again which is a welcome move. Melbourne remains effectively closed while Brisbane remains my pick due to the large differential in pricing between the states. The growth of consulting and working from home via ZOOM will also make regional cities increasingly attractive as a more cost effective option.

Debt Vs Interest Payments (Source: Budget 2020-2021)

We are pleased to advise that the Manly Skiff Club has been booked for our client function on the evening of Thursday 10th December with invitations to be sent shortly. The club has advised that subject to any new State Government directives we will be able to have a good sit down meal and that with sensible social distancing we can have a great time together celebrating Christmas and hopefully a growing normality in our community. We will also invite you to a significant online function so clients out of town and overseas can enjoy a similar experience with quality guest speakers. As always I thank you for your valued referrals which are the life blood of new business – please keep them coming at info@virtueandpartners.com.au

We look forward to seeing many of you face to face soon.

Tony